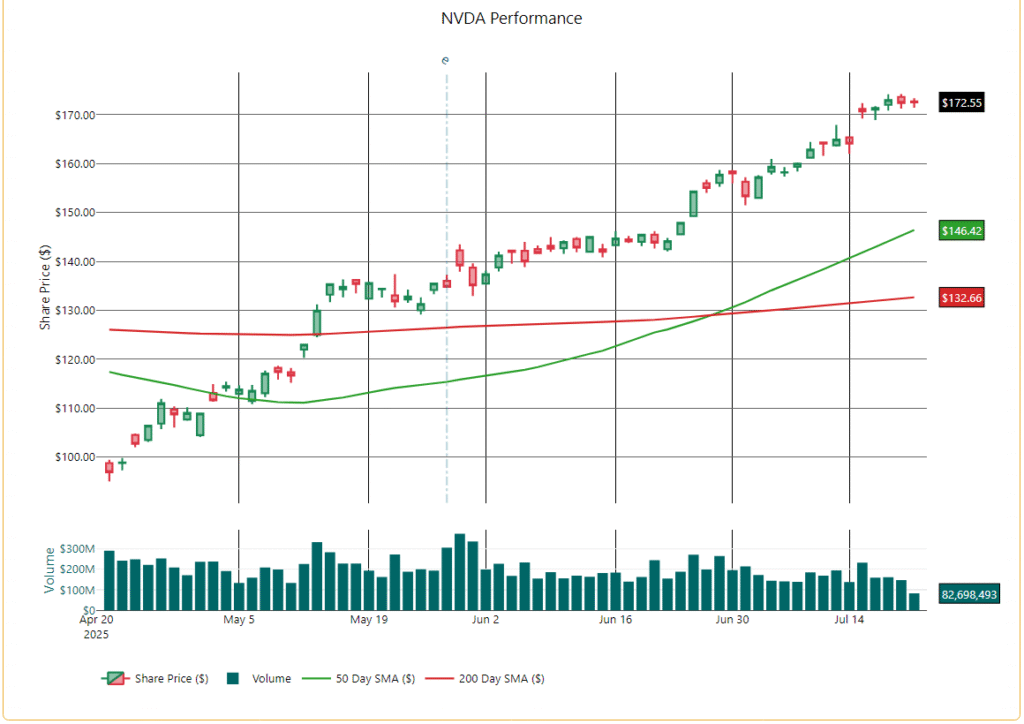

NVIDIA's (NVDA) 19% Surge: AI Momentum Pushes Stock to Record Highs

Between June 24 and July 21, 2025, NVIDIA (NVDA) rose nearly 19%, driven by analyst upgrades, key milestones, and improving sentiment around AI. The rally followed a recovery from April’s tariff concerns and gained momentum after Trump’s Middle East trip, which boosted global AI investment and demand for NVIDIA chips. This timeline highlights the catalysts that reinforced NVIDIA’s leadership in the AI space.

June 24, 2025

- Stock Move: +1.3% to ~$146

- Catalyst: Easing geopolitical tensions (Middle East conflict cooled). Broad tech sector rebound led by renewed risk appetite.

- Impact: Lifted sentiment across high-growth AI names like NVIDIA.

June 25, 2025

- Stock Move: +4.3% to $154.31 (record close)

- Catalyst:

- Loop Capital raised NVDA target to $250, citing a “Golden Wave” of AI compute demand.

- Analysts highlighted NVIDIA’s leadership in next-gen chips and growth in data center revenue.

- Broad media coverage on NVDA surpassing Microsoft in market cap.

- Impact: Strong institutional buying and momentum.

June 26, 2025

- Stock Move: Flattish but held gains

- Catalyst: Continued positive coverage on NVIDIA’s $1.4 trillion rebound and strength in its Blackwell AI platform.

- Impact: Sustained investor confidence at all-time highs.

June 28–July 3, 2025 (Holiday-shortened week)

- Stock Move: Gradual rise to ~$158

- Catalyst:

- Continued inflows into AI sector.

- Rotation back into megacaps after economic data showed slowing inflation.

- Impact: Passive inflows supported NVIDIA as a top AI proxy.

July 8–10, 2025

- Stock Move: Surged to ~$165

- Catalyst:

- Nvidia became the first public company to hit $4 trillion market cap.

- Optimism around the next Blackwell superchip cycle.

- Impact: Milestone created a bullish sentiment loop and triggered more retail/institutional FOMO buying.

July 15–18, 2025

- Stock Move: Climbed to ~$171

- Catalyst:

- Multiple analyst upgrades: Mizuho, Jefferies, and Needham all raised their targets to ~$190–$200.

- Goldman Sachs initiated coverage with a Buy rating.

- Broader Nasdaq rally driven by declining bond yields.

- Impact: Reinforced NVDA’s narrative as the top AI growth stock; maintained strong uptrend.

July 19–21, 2025

- Stock Move: Consolidated around $172.55

- Catalyst:

- Continued bullish commentary and insider attention (Rep. Bresnahan disclosed recent purchase).

- Decline in AI chip regulation risk, boosting chipmaker sentiment.

- Impact: Stock showed resilience and held near highs ahead of potential earnings or guidance updates.

🧾 Summary

From June 24 to July 21, NVDA rose ~19%, driven by:

- AI leadership reaffirmation

- Strong analyst upgrades

- Milestone market cap achievements

- General tech market tailwinds

NVIDIA remains a momentum leader with strong sentiment, bolstered by both fundamentals and macro conditions.