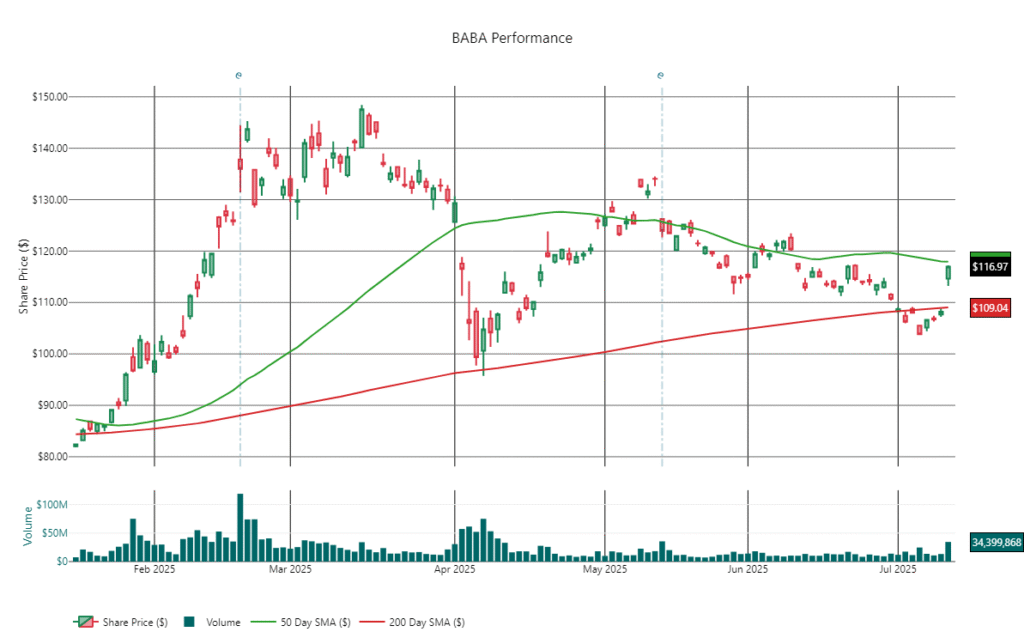

Alibaba (BABA) Testing Critical Resistance at $117

Current Price: $116.97

Daily Gain: +8.1%

Momentum: Strong volume surge confirms renewed investor interest YTD Performance: +37.95%

Post-Earnings (May) Decline: -5.59% since last earnings report

🔍 Price Action & Trend Overview

- BABA has rebounded sharply from ~$109 in early July and is now testing critical resistance near $117.

- This marks a potential trend reversal point after a multi-month downtrend.

📐 Fibonacci Retracement Levels

(Based on 52-week high: $148.43 | Low: $73.87)

- 23.6%: $92.13 (support)

- 38.2%: $103.01 (support)

- 50.0%: $111.15 (support)

- 61.8%: $119.29 (resistance)

- 78.6%: $131.33 (major resistance)

🧭 Key Moving Averages

- 50-Day SMA: $117.93 → Immediate resistance

- 200-Day SMA: $109.04 → Strong support, trending upward

BABA has reclaimed its 200-day SMA, a bullish long-term signal. However, it’s just under the 50-day SMA, which must be broken and held for confirmation of further upside.

💡 Support & Resistance Zones

- Immediate Support: $108–$110 (200-day SMA area)

- Next Support: $103.01 (Fibo 38.2%), then $92.13

- Immediate Resistance: $117–$119.29 (50-day SMA + 61.8% Fibo)

- Next Resistance: $131.33 (78.6% Fibo), then $140–$150 (2025 peaks)

📊 Volume & RSI

- Volume: 34.4M (well above average) → strong conviction behind the move

- RSI (14): 56.78 → Neutral zone; momentum rising but not overbought

🌏 Market Drivers & Sentiment

Bullish Catalysts:

- AI Optimism: Strong interest in Alibaba’s AI and cloud innovation

- Southeast Asia Expansion: New data centers and regional growth

- Taobao Stimulus: Large subsidy plans to boost e-commerce sales

- Analyst Ratings: Consensus “Strong Buy,” price targets $135–$180

Risks to Watch:

- Margin Pressures: Ongoing price wars in China’s food delivery space

- Geopolitical Uncertainty: Continued sensitivity to U.S.–China trade and tech restrictions

✅ Summary & Action Levels

- Trend: Neutral-to-bullish

- Confirmation Needed: Break above $117–$119.29 for bullish continuation

- Bullish Scenario: Clear move through resistance targets $131+

- Bearish Scenario: Drop below $111.15 could retest $103 or even $92

📌 Bottom Line:

BABA is at a technical inflection point. A breakout above the 50-day SMA and 61.8% retracement would confirm trend reversal and invite momentum buying. Strong volume backs the move, but resistance is close. Watch the $117–$119 zone carefully.