TSSI AI-Fueled Growth Faces Technical Test at Key Support

AI-driven infrastructure growth, explosive revenue, but rising caution

🧠 Company Overview

TSS, Inc. provides data center infrastructure and integration services, with a sharp focus on AI and high-density computing builds. Their offerings include:

- Rack and system integration

- Procurement for hyperscalers

- Data center engineering and support

- Facility and cybersecurity services

In 2025, they expanded operations with a new integration facility in Georgetown, TX, aiming to triple capacity for AI deployments.

💥 Stock Surge: What’s Driving the Rally?

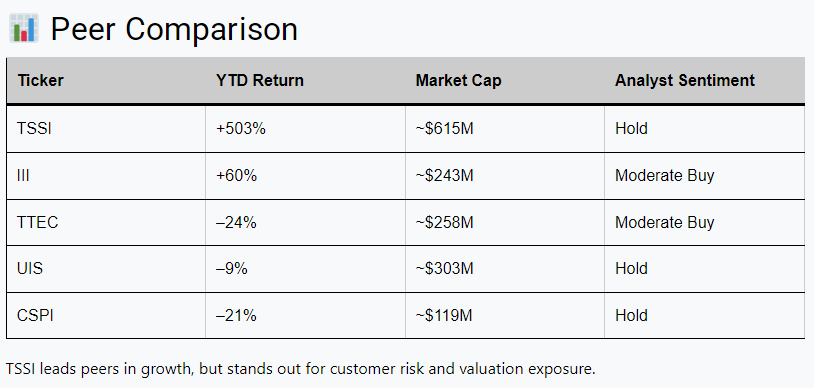

TSSI is up 500%+ YTD, triggered by:

- Insider buying in late April

- Q1 2025 blowout earnings on May 15:

- Revenue: $99M (+523% YoY)

- EPS: $0.12 vs breakeven prior

- Adjusted EBITDA: $5.2M

- Momentum from AI infrastructure demand

- CEO guided for 50% EBITDA growth in 2025

🧾 Recent Analyst Activity

- June 23: Downgraded from Buy → Hold by Wall Street Zen

- No new upgrades since May

- Valuation concerns rising, with multiple analysts suggesting the stock may be overvalued

🧩 Risk Factors

- Customer concentration: ~96–99% of revenue tied to one OEM (likely Dell)

- Valuation stretched: Models estimate fair value between $6.50 and $20.95

- Technical signals turning cautious

🧾 TSSI – Technical Breakdown (as of July 13, 2025)

Current Price: $20.51

52-week Range: $2.12 – $31.94

Volume (Last Close): 2.63M

RSI (14-day): 43.3 (Neutral)

🔍 Trend Overview

- Price above 50-day ($17.59) and 200-day ($11.60) → bullish long-term trend

- Recent pullback (~32%) from highs introduces short-term caution

📐 Fibonacci Levels (from $2.12 to $31.94)

- 61.8%: $20.36 → key support being tested now

- 50%: $17.03 → next major support

- 38.2%: $13.71

- 78.6%: $25.49 → next resistance

- 100%: $31.94 → all-time high

🔄 Support & Resistance

Support:

- $20.36 (Fibo 61.8%)

- $17.03 (Fibo 50%)

- $13.71 (Fibo 38.2%)

Resistance:

- $25.49 (Fibo 78.6%)

- $28.96 (swing high from July 7)

- $31.94 (52-week high)

📈 Volume & Momentum

- Volume remains high → traders active on both sides

- RSI at 43.3 → momentum cooling, neutral-to-weak

- Not yet oversold, but approaching levels where bounce setups emerge

✅ Actionable Summary

- Hold above $20.36 keeps bullish structure intact

- Rebound targets: $25.49, then $28.96

- Break below $20.36 → likely test of $17.03

- RSI reset + high volume = possible setup, but needs confirmation

This is an AI-assisted analysis for informational purposes only. Not a recommendation to buy or sell securities. Always do your own research and consult a licensed advisor.