AppLovin (APP) up +7.0% Citi Reaffirms Buy Rating

Rating: Buy | Price Target: $600

Current Price: $359.50 (+7.0%)

- Citi reiterated its Buy rating and $600 price target, expressing strong confidence in AppLovin’s long-term growth.

- Analysts are optimistic about the company’s Axon AI-powered ad platform, growing e-commerce ad vertical, and upcoming self-serve tools expected later this year.

- The recent $400M sale of its gaming division to Tripledot is seen as a strategic shift to focus on higher-margin ad tech.

- Citi believes AppLovin is well-positioned to benefit from changes in mobile monetization and app store economics.

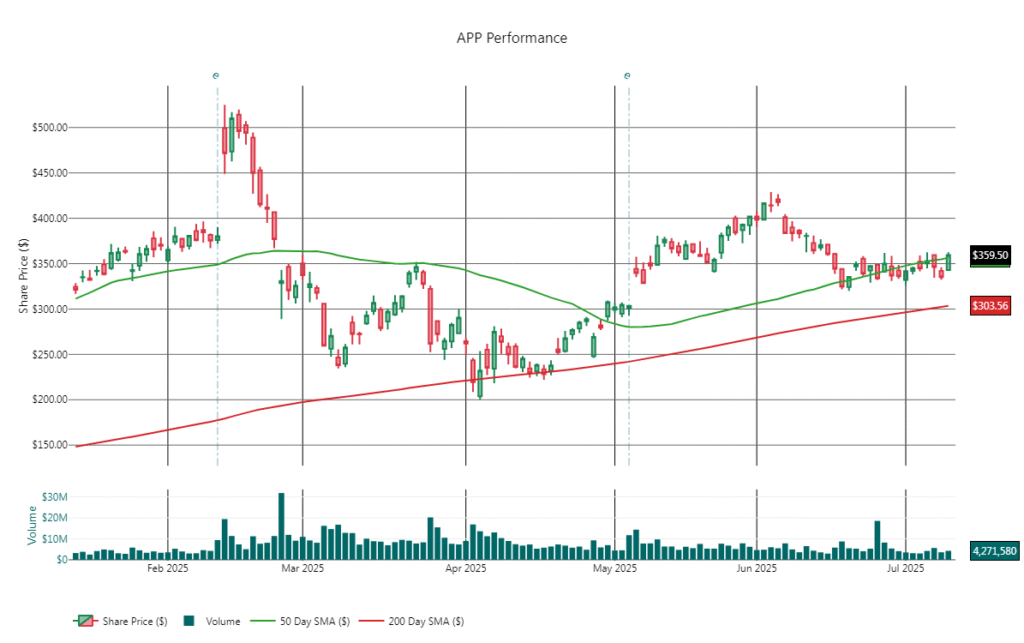

📉 Technical Analysis – AppLovin (APP)

As of July 14, 2025 | Price: $359.50 (+7.0%)

📈 Trend & Moving Averages

- 50-day SMA: ~$354.84 → Price now above = short-term bullish tilt

- 200-day SMA: ~$303.56 → Long-term uptrend intact

- Trend: Bullish bias returns after consolidation; momentum building

🔁 Fibonacci Retracement (Low $279.49 → High $416.52)

- 23.6%: $312.11 → Minor support

- 38.2%: $328.49 → Firm support

- 50.0%: $348.01 → Key pivot (reclaimed today)

- 61.8%: $367.54 → Immediate resistance

- 78.6%: $393.12 → Major resistance ahead

📊 Momentum & Volume

- RSI (14): 52.4 → Neutral zone

- Volume: ~4.2M vs 6.25M avg → Slight pickup needed to confirm breakout

🧱 Support & Resistance

- Support:

- $348.01 (reclaimed today)

- $328.49

- $312.11

- Resistance:

- $367.54

- $393.12

🧭 Price Action Highlights

- Today’s +7% surge pushed APP decisively above the 50-day SMA and pivot zone

- Ongoing consolidation appears to be resolving upward

- Setup favors bulls if price clears $367.54 with volume

⚠️ Key Takeaways

- Breakout Signal: Above $367.54 = opens move toward $393

- Support to Watch: $348 now a critical level to hold

- Neutral Range: $348–$367 = former chop zone

- Macro View: Citi’s $600 target underscores longer-term bullish thesis

Bottom Line:

AppLovin jumped 7% today after reaffirmed bullish coverage from Citi. The stock is back above key support and nearing resistance. A strong breakout above $367 could reignite momentum toward the $393–$400 zone, keeping Citi’s $600 long-term target in focus.