NVIDIA (NVDA), Tesla (TSLA) Top Monthly Options Volume Leaders – July 2025

🔍 Overview

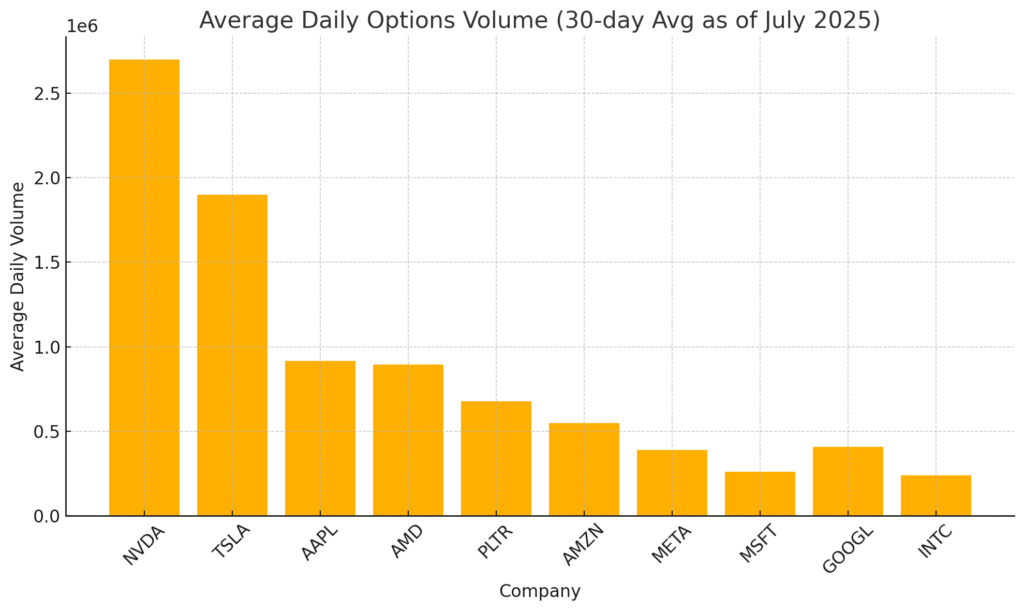

Based on TradeStation data as of July 23, 2025, the following stocks led U.S. equity options trading by average daily volume over the past 30 days.

📦 Average Monthly Options Volume (≈30 Day Avg, as of July 23, 2025)

| Ticker | Company | Approx. Avg Daily Volume |

|---|---|---|

| TSLA | Tesla | ~1.9 M contracts |

| NVDA | NVIDIA | ~2.7 M contracts |

| AMD | AMD | ~896K contracts |

| AAPL | Apple | ~917K contracts |

| GOOGL | Alphabet | ~408K contracts |

| INTC | Intel | ~240K contracts |

| MSFT | Microsoft | ~261Kcontracts |

| META | Meta | ~390K contracts |

| AMZN | Amazon | ~548K contracts |

| PLTR | Palantir | ~677K contracts |

These figures reflect activity in the 30 days leading up to ~July 23, 2025. NVIDIA averaged the highest monthly activity (~2.7 million), followed by Tesla (~1.9 M), with Apple and AMD also exceeding ~900k per day

📉 Trend Chart

The following chart visually compares the average daily options volume across these major tickers:

- NVIDIA is the standout leader in options activity, even ahead of Tesla.

- Tesla remains highly active but trails behind NVIDIA on monthly averages.

- AMD and Apple are closely matched in third and fourth place.

- Palantir, Amazon, and Meta form the mid-tier activity group.

🧠 Insight

- Speculative trading and earnings events likely contributed to elevated volumes in NVIDIA and Tesla.

- While AMD briefly spiked, its average volume remains behind the top two.

- Stocks like GOOGL, MSFT, and INTC have consistent but comparatively lower options interest.

This is an AI-assisted report created for informational and educational purposes only. It does not constitute financial advice or a recommendation to buy or sell any securities.