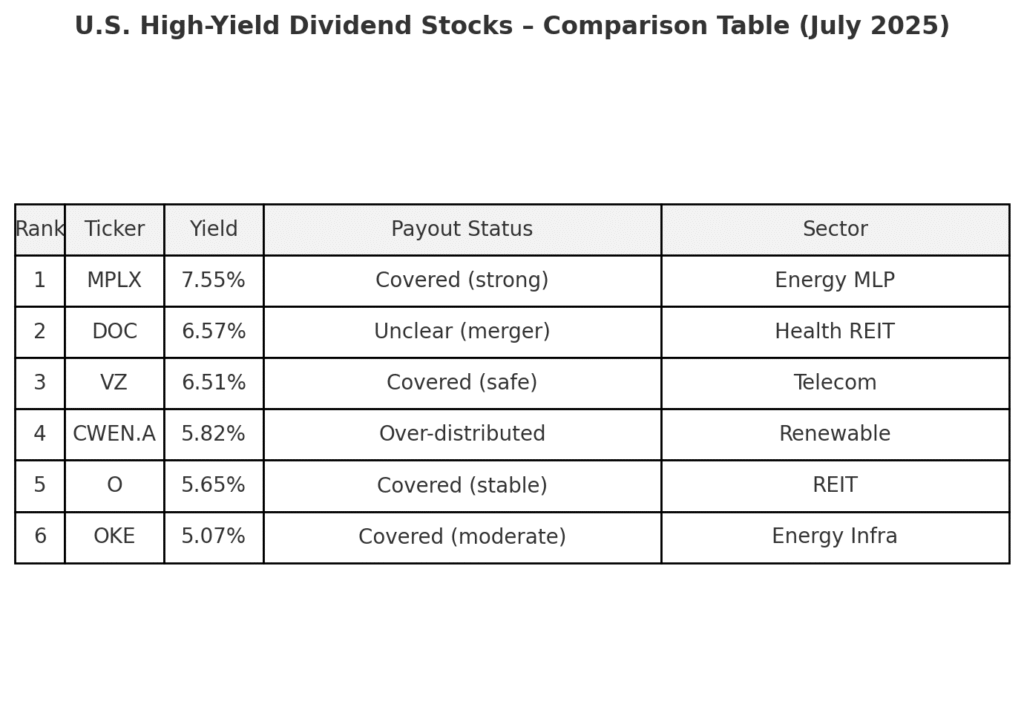

U.S. High-Yield Dividend Stocks Offer Potential Returns

This report highlights several large-cap U.S. stocks offering dividend yields above 5% with varying levels of safety, as of mid-July 2025.

MPLX LP (NYSE: MPLX)

- Dividend Yield: ~7.55%

- Payout Ratio: ~86% of earnings

- Structure: Master Limited Partnership (MLP)

- Key Points:

- Operates 10,000+ miles of midstream infrastructure

- Strong dividend coverage with consistent cash flow

- Expected EPS growth through 2026

- Issues a K‑1 tax form

Realty Income (NYSE: O)

- Dividend Yield: ~5.65%

- Payout Ratio: ~84% of AFFO

- Structure: Monthly-paying REIT

- Key Points:

- 131 consecutive monthly dividend increases

- Broad tenant base with long-term leases

- Reliable income source; interest rate sensitivity applies

Clearway Energy (NYSE: CWEN.A)

- Dividend Yield: ~5.82%

- Payout Ratio: ~215% of CAFD

- Key Points:

- Portfolio includes solar and wind assets

- Payout currently exceeds cash available for distribution

- Faces risks from PG&E exposure and weather-dependent generation

Healthpeak Properties (NYSE: DOC)

- Dividend Yield: ~6.57%

- Structure: Healthcare REIT (post-merger of PEAK and DOC)

- Key Points:

- Focused on outpatient medical facilities

- Ongoing portfolio restructuring after merger

- Leverage and integration execution are key watch areas

Oneok Inc. (NYSE: OKE)

- Dividend Yield: ~5.07%

- Payout Ratio: ~79% of earnings

- Key Points:

- Provides infrastructure for natural gas liquids

- Solid history of dividend coverage and modest growth

- Exposed to commodity price swings

Verizon Communications (NYSE: VZ)

- Dividend Yield: ~6.51%

- Key Points:

- Strong free cash flow supports dividend

- Investing heavily in 5G expansion

- Faces competitive pressure from T-Mobile and AT&T

Note: Data current as of July 13, 2025. Dividend yields and payout ratios may change with stock prices or company updates.

This is an AI-assisted report for informational purposes only. It is not financial advice or a recommendation to buy or sell any security.