UNFI Soars 12% After Cyberattack Update

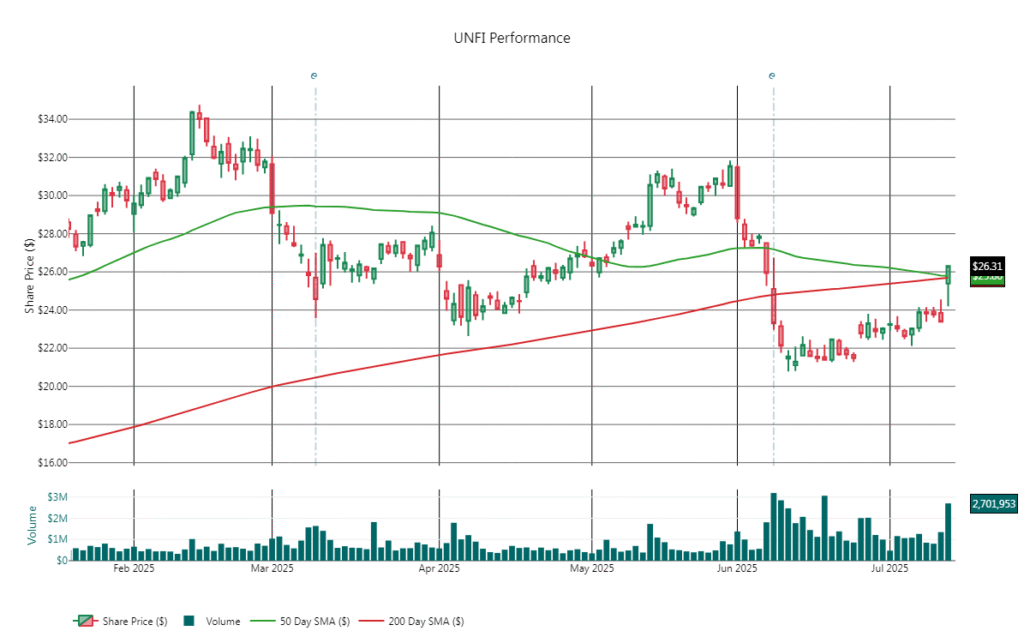

📍 Stock closed at $26.26, up $2.87 (+12.27%)

United Natural Foods (UNFI) surged over 12% after holding a business update call that addressed the financial fallout from its June cyberattack and reaffirmed full-year guidance.

🔍 Key Updates

- Estimated $350–$400M FY25 sales impact from the attack

- Insurance coverage expected to offset most losses

- Operations fully restored, with order systems back online

- Guidance reaffirmed, easing market concerns

📉 Quick Recap of Cyberattack Fallout

- Detected June 5, disclosed publicly June 9

- Disrupted deliveries to major grocers like Whole Foods

- Stock fell from $31.55 (June 2) to below $23 in mid-June

- Rebounded sharply July 16 on renewed confidence

🔍 UNFI Is Testing a Critical Level

UNFI is currently trading at $26.29, right at a critical confluence zone where price meets:

- The 50-day SMA (~$25.80)

- The 200-day SMA (~$25.69)

- And just above the 61.8% Fibonacci retracement level (~$25.36)

This cluster of technical signals makes $25.36–$26.30 a high-stakes battleground for the stock’s next move.

🔑 Key Technical Levels

- Support Levels:

- $25.36 – Critical support (Fibo 61.8%)

- $23.38 – Next major support (Fibo 50%)

- $21.39 – Deeper support (Fibo 38.2%)

- Resistance Levels:

- $29.03 – Fibonacci 78.6% retracement (near-term upside target)

- $34.76 – 52-week high (major breakout level)

📈 Trend & Volume

- Price has crossed above both 50- and 200-day SMAs, signaling a potential trend shift to bullish.

- RSI at 63.17 – strong but not overbought, leaving room for further upside.

- Volume at 2.76M, more than double the average – confirms conviction behind the move.

✅ Actionable Opinion

- Bullish case stays intact as long as price holds above $25.36.

- A break above $26.50 with sustained volume would likely trigger momentum toward $29.00.

- Failure to hold $25.36 opens the door to a retracement toward $23.38 or lower.

- Traders can consider initiating a position on pullbacks above $25.36 with a stop just below.

📌 Bottom Line:

UNFI is at a technically significant juncture. Holding this level may confirm a trend reversal, while failure to do so could signal a false breakout. Stay alert for confirmation above $26.50 or weakness below $25.36.

This report is made with AI assistance and is not investment advice.