Marriott International (MAR) at Crossroads

🔹 Upcoming Earnings

- Date: Early November 2025 (Nov 3, BMO)

- Estimates: Revenue $6.46B (+3.27% YoY), EPS $2.38 (+$0.12 YoY)

🔹 Management & Industry Highlights (Q2 2025 Call – Aug 5, 2025)

- RevPAR Guidance: FY25 +1.5%–2.5% (low end of prior range); Q3 expected flat to +1%.

- Regional Trends: International strength (APAC +9%, EMEA +7%, Middle East +10%) offsetting flat U.S./Canada and weakness in Greater China (–0.5%).

- Pipeline: Record 590k rooms, ~40% under construction; conversions ~30% of signings/openings.

- Growth Drivers: Launch of Series by Marriott mid-scale brand, citizenM acquisition, ongoing AI/tech initiatives.

- Financial Outlook: FY25 adj. EBITDA $5.3–5.4B (+7–8% YoY). Q3 gross fee revenue +2–3% but incentive fees pressured by renovations and hurricanes.

- Industry Context: U.S. hotel demand plateauing (occupancy lower, ADR flat, RevPAR slightly negative). Rising labor, utilities, and insurance costs squeezing margins across the sector.

🔹 Recent Earnings Performance

- Q2 2025 (Aug 5): $6.74B revenue vs. $6.67B est (+4.7% YoY); $2.65 EPS vs. $2.61 est (+$0.15 YoY).

- Track Record: 5 of last 6 quarters revenue beats, steady +4–6% YoY growth. EPS more volatile due to margin pressures.

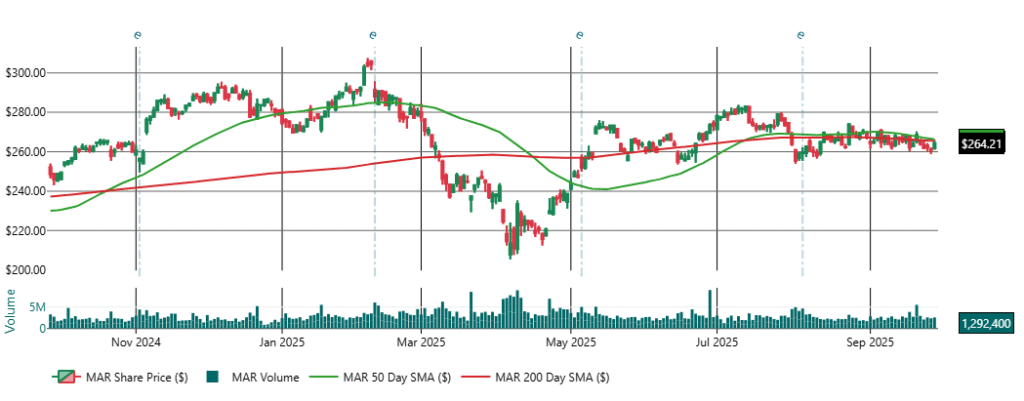

🔹 Technical Picture

- Current Price: $264.21

- 50-Day SMA: $266.34

- 200-Day SMA: $265.39

- RSI (14d): 48.7 → Neutral

- Resistance Levels: $266.00 (immediate), $270.02 (secondary), $280.00 (major).

- Downside Support Levels:

- $260.51 – immediate support

- $258.26 – strong near-term

- $252.00 – major test level

- $245.75 – deeper support

- $239.00 – next pivot zone

- $230.00 – longer-term base support

Trend: Sideways / slightly bearish, with price consolidating around both SMAs on muted volume.

🔹 Conclusion

Marriott’s fundamentals remain steady internationally, but U.S. softness and cost inflation are tempering earnings momentum. Shares are in consolidation mode, with Q3 earnings in early November as the next major catalyst. Technically, the stock faces resistance at $266–270, while a breakdown below $260 could open the way toward $252, $245, or even $239 in an extended move lower.