Ferguson plc (FERG) - Earnings Preview & Outlook

Upcoming Report Date: September 16, 2025 (Q4 & full fiscal year 2025)

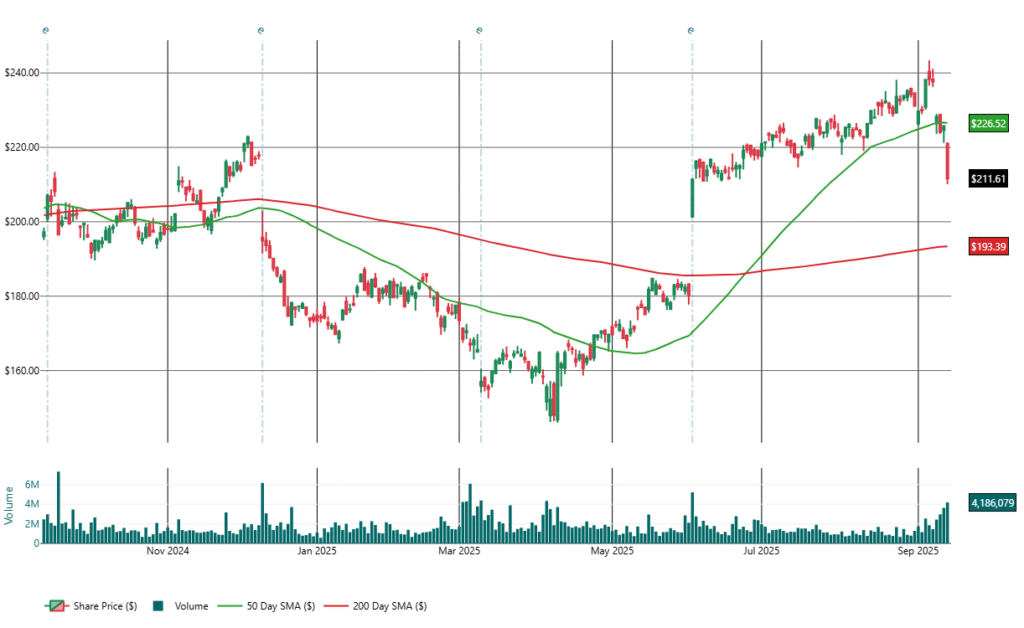

Recent Price Action: Shares have fallen for four straight sessions, down ~6% and closing at $211.6 after breaking below the 50-day SMA (~$226).

📉 Recent Stock Performance & Technicals

- Shares trending lower with heavy selling volume.

- Support: $210 (short-term), $200 (psychological), $193 (200-day SMA).

- Resistance: $225–227 (prior support + 50-day SMA).

- Short-term momentum is bearish; a sustained move above $225 is needed to shift sentiment positive.

🧾 Q3 (April 30, 2025) 10-Q Highlights

- Revenue: $7.62B (+4.3% YoY).

- Net Income: $410M (−7.4% YoY).

- GAAP EPS: $2.07 (−5%).

- Adjusted EPS: $2.50 (+7.8%), lifted by $70M restructuring add-backsferg 10Q.

- Gross Margin: 31% (up from 30.5%).

- SG&A: +5.2% YoY, outpacing revenue growth.

- Tax Rate: 26.4% vs. 23.8% YoY.

- Operating Cash Flow: $1.37B YTD vs. $1.51B last year.

👉 Takeaway: Sales growth solid, but GAAP earnings pressured by restructuring, higher costs, and tax headwinds.

📞 Key Earnings Call Insights (Q3, June 3, 2025)

- Growth Drivers:

- HVAC revenue +10% and Waterworks +12%, boosted by infrastructure investment.

- Early signs of recovery in U.S. residential construction.

- Restructuring: $68M charge expected to yield ~$100M in annualized cost savings; actions intended to simplify operations and improve efficiency.

- Guidance:

- Revenue outlook raised to low-to-mid single-digit growth (from low single-digit).

- Operating margin guided to 8.5%–9.0%.

- CEO Kevin Murphy: Emphasized success in capturing value and supporting complex project needs across both residential and non-residential markets.

- CFO Bill Brundage: Highlighted disciplined cost control despite inflation, confident in sustaining gross margins.

- Risks discussed: Commodity deflation, tariff volatility, inflation in labor/logistics.

🏗️ Revenue Mix

- United States: 96% of revenue.

- Residential: 49%.

- Non-residential: 51% (Commercial 34%, Civil 9%, Industrial 7%).

- Canada: 4%.

👉 Balanced between residential & non-residential, with non-residential now slightly larger.

🏢 Competitive Landscape

- Core & Main (CNM): Direct rival in waterworks/infrastructure.

- Watsco (WSO): HVAC leader.

- Builders FirstSource (BLDR): Residential building materials.

- Beacon Roofing (BECN): Roofing products.

- Fastenal (FAST), MSC (MSM): Broader industrial distribution.

👉 Ferguson’s competitive edge: scale, breadth, diversification. Risks: CNM gaining share in infrastructure; WSO dominates HVAC.

📈 Expectations for Q4 Earnings (Sep 16, 2025)

Consensus:

- Revenue: $8.39B (+5.6% YoY).

- EPS: $3.01 (+1% YoY).

What Investors Will Watch Closely:

- Guidance for FY26: Must reassure despite macro uncertainty.

- Margins: Need to stay above 30% amid cost inflation.

- Non-residential growth: Commercial & infrastructure strength to offset residential softness.

- Cash flow: Investors want stability after recent decline.

- Restructuring: Clarity if $68–70M charges were truly one-off.

🔄 Recent Analyst Rating Changes — Ferguson plc (FERG)

- Sep 4, 2025 — JPMorgan (Patrick Baumann): Target price raised $220 → $225, rating Overweight (maintained).

- Jul 8, 2025 — Wells Fargo (Sam Reid): Target price raised $230 → $250, rating Overweight (maintained).

- Jun 18, 2025 — Goldman Sachs: Initiated coverage with Buy, target price $280.

- Jun 9, 2025 — Morgan Stanley (Annelies Vermeulen): Target price raised $195 → $220, rating Overweight (maintained).

- Jun 4, 2025 — Oppenheimer: Target price raised $189 → $235, rating Outperform (maintained).

- Jun 4, 2025 — RBC Capital: Target price raised $189 → $231, rating Outperform (maintained).

- Jun 4, 2025 — UBS: Target price raised $173 → $204, rating Neutral (maintained).

- Jun 5, 2025 — Berenberg: Downgrade from Strong Buy → Hold, target price around $215.

Consensus: Overall “Moderate Buy”, with average price target around $221–222.

⚖️ Risk vs. Reward

- Bull case:

- EPS & revenue beat, gross margin >30%.

- Strong infrastructure/commercial growth continues.

- Confident FY26 guidance.

- Stock rebounds toward $225–230.

- Bear case:

- Miss on EPS or cautious guidance.

- Persistent SG&A inflation and tax headwinds.

- Stock tests $200–193.

🎯 Final Take

- Short-term view: Cautious. The 4-day selloff shows investors are de-risking ahead of earnings. Technical breakdown reinforces near-term pressure.

- Medium-term: Still a solid operator with scale advantage, but must prove consistent GAAP EPS growth beyond adjustments.

- Actionable stance:

- Traders: Avoid chasing; better entry closer to $200–193 support.

- Investors: Long-term fundamentals remain attractive, but safer to reassess after Q4 earnings clarity.