Domino’s Pizza (DPZ) Shows Mixed Earnings Results

Date: October 15, 2025

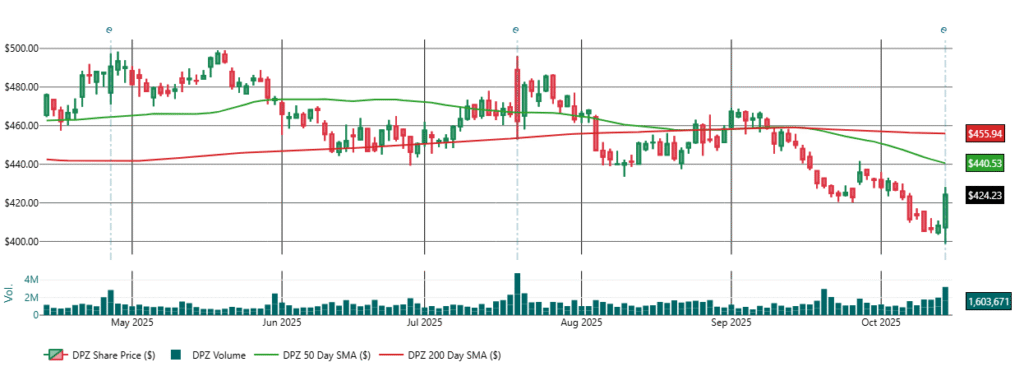

Share Price: $424.23

50-day SMA: $440.53 | 200-day SMA: $455.94

Trend: Bearish (Death Cross Confirmed)

Earnings Recap (Q3 2025)

- Date Released: October 14, 2025

- Revenue: $1.147 B (+6.2% YoY, roughly in line with estimates)

- Non-GAAP EPS: $4.08 (vs. $4.19 YoY, −2.6%) — slight beat vs. consensus of $3.99

- Operating Income: $223.2 M (+12.2%) | Net Income: $139.3 M (−5.2%)

- Same-Store Sales: U.S. +5.2% | International +1.7% (ex-FX)

- Store Growth: +214 net (29 U.S., 185 Intl.)

- Tax Rate: 22.3% (up from 20.4%)

- Management Commentary: CEO Russell Weiner highlighted steady execution under the “Hungry for MORE” strategy and strong U.S. momentum despite margin pressure.

Takeaway:

Solid top-line and comp growth with slight EPS contraction from tax impact and promotions. Fundamentals remain healthy but not yet strong enough to change technical sentiment.

Technical Overview

| Indicator | Value / Level | Interpretation |

|---|---|---|

| Price vs. SMAs | Below both 50- and 200-day | Bearish alignment |

| Death Cross | 50-day < 200-day (formed late Sep ’25) | Confirms long-term downtrend |

| RSI (14-day) | ~46 | Neutral / rebounding from oversold |

| Williams %R | −40 to −45 | Neutral zone |

| ADX | ~33 | Moderate trend strength |

| Volatility (Std Dev) | ~10 | Moderate |

| Volume | Rising on green candles | Short-covering / dip-buying evident |

Support & Resistance (Fibonacci-based)

Recent High: $486 (July 28 2025) | Recent Low: $398.81 (Oct 14 2025)

| Type | Level | Comment |

|---|---|---|

| 1st Support | $427.9 (14.6%) | Near-term support floor |

| 2nd Support | $413.6 | Re-test zone |

| Major Support | $398.8 | Key pivot — break = capitulation risk |

| 1st Resistance | $445.7 (23.6%) | First bounce target |

| 2nd Resistance | $460.9 (38.2%) | Strong overhead barrier |

| 3rd Resistance | $471.4 (50%) | Confirms reversal if cleared |

Trend and Death Cross Significance

- The death cross confirms that both medium- and long-term momentum have turned negative, indicating institutional selling and a structural downtrend.

- Historically, DPZ consolidates for 1–3 months after such crosses before forming a durable base or a final flush.

- Until price closes above $455–$460, rallies are more likely to face resistance than evolve into a sustained uptrend.

Forward Scenarios (1–3 Month Outlook)

| Scenario | Probability | Range | Implication |

|---|---|---|---|

| Sideways Base Formation | 65% | $400 – $450 | Stabilization; possible pre-reversal base |

| Breakdown Below $395 | 20% | $370 – $385 | Capitulation low before bottoming |

| Reversal Breakout > $455 | 15% | $470 – $490 | Confirms trend change; targets $490+ |

Trading Strategy

- Long Bias: Enter only on breakout above $445–$455 with RSI > 50 and volume confirmation.

- Short Bias: Fade rallies near $445–$450 if rejection occurs and momentum turns lower.

- Stop Zone: Below $395 (major support breach invalidates base thesis).

Summary

Domino’s delivered a resilient Q3 with solid sales growth and manageable margin pressure, but the technical backdrop remains bearish following the September death cross. The stock appears to be entering a base-building phase between $400 and $450, where stabilization is more probable than a new rally. A decisive move above $455 is required to confirm any reversal. Until then, the bias stays neutral-to-bearish, with downside risk contained near $400.

Disclaimer: This report was AI-generated for informational purposes only and does not constitute financial advice or a recommendation to buy or sell any securities.