NVIDIA (NVDA) Earnings Setup: Revenue Growth Expected

Earnings Date: Nov 19, 2025 (AMC)

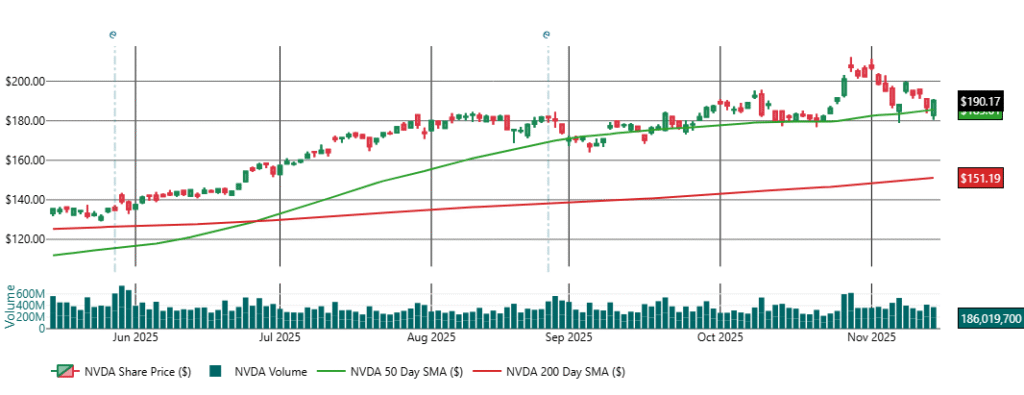

Last Price: $190.17

Volume: 186.6M

52-Week Range: $86.62 – $212.19

1. Earnings Setup

Upcoming Quarter (Q3 FY26 – ending Oct 27, 2025)

- Revenue Estimate: $54.94B

- YoY Growth Estimate: +56.62%

- EPS Estimate: $1.24

- YoY EPS Growth Expected: +0.43

Recent Earnings Pattern (Trailing 6 Quarters)

NVDA has:

- Beat revenue estimates 6 out of 6 quarters

- Beat EPS estimates 6 out of 6 quarters

- YoY revenue growth has ranged 55% → 122%

- EPS YoY growth has ranged 20% → 262%

Recent Actuals:

- Aug 27, 2025:

- Revenue $46.74B vs $46.05B est (Beat)

- EPS $1.05 vs $1.01 est (Beat)

- YoY revenue growth: +55.60%

- Prior quarters:

- May 2025: $44.06B (Beat)

- Feb 2025: $39.33B (Beat)

- Nov 2024: $35.08B (Beat)

- Aug 2024: $30.04B (Beat)

- May 2024: $26.04B (Beat)

Conclusion:

NVDA consistently beats, but the beat margin has narrowed.

The market now requires revenue acceleration + strong forward guidance to justify upside.

2. Key Insights From Last Conference Call (Q2 FY26)

Strongest Drivers

- Revenue $46.7B, powered by:

- +56% YoY Data Center growth

- Multiple AI platform transitions

- CEO Jensen Huang projects $3–$4 trillion in global AI infrastructure spending this decade.

- Positioning for reasoning agentic AI — heavy compute → continues GPU demand cycle.

Guidance Provided:

- Next-quarter revenue forecast: $54B

- Gross margins projected at 73.3–73.5%

Challenges:

- China licensing restrictions affecting H20

- Supply chain geopolitics remain a wild card

- NVDA must continuously innovate to retain share against AMD, Intel, and custom silicon

Capital Allocation

- $60B share buyback authorization signals confidence + ongoing EPS support

Fundamental Summary:

NVDA remains the uncontested leader in AI compute, with fundamentals stronger than any other mega-cap.

But expectations are extremely high, making earnings reaction more volatile.

3. Technical Analysis

Trend

- Above 50-day SMA ($185.61)

- Above 200-day SMA ($151.19)

→ Long-term uptrend intact

Short-term Trend: Sideways / Weak

- ADX 17.39 → weak momentum

- RSI 49.4 → neutral

- Williams %R –66 → mild bearish but not oversold

→ NVDA is coiling ahead of earnings

Support Levels

- $186.80–187.00

- $183.00

- $180.50

- $176.00 (critical multi-month floor)

Resistance Levels

- $191.00

- $193.80

- $195.70 (key breakout)

- $200.00

- $212.19 (52-week high)

Pattern

- A tight falling wedge inside a rising long-term channel

→ These typically resolve bullish if earnings support continuation

Volatility

- Std Dev (14-day): 6.66

- NVDA historical earnings move: 8–12% in either direction

4. Integrated View: Fundamentals + Technicals + History

Bullish Case (Higher Probability If Guidance > $54.94B)

- NVDA has never missed in two years

- Data center demand remains dominant

- Gross margins are still in the 73% range, showing pricing power

- Share buybacks provide EPS support

- Technical structure supports a breakout above $195–200

- RSI neutral → room for upside expansion

If bullish:

NVDA likely targets $200 → $212 → $225

Bearish Case (Triggered if China commentary worsens or guidance is soft)

Market sensitivity is highest around:

- China export restrictions

- Rubin platform transition timing

- AI spending sustainability

If NVDA disappoints even slightly, downside levels are:

- $186 → $183 → $180

- $176 is major support

- Break of $176 = correction toward $160–165

Bearish probability rises if revenue guide comes in < $54B.

5. Earnings Playbook

Current Market Positioning:

NVDA is neutral, balanced, and coiled — perfect setup for a large candle post earnings.

My Actionable Read (Based on full data)

Short term (1–7 days):

- Neutral → Slightly Bullish bias

- Stock is above 50-day and 200-day MAs

- RSI is reset

- Fundamentals strong

- Buybacks offer a price cushion

But the actual move depends on guidance > execution.

Actionable Triggers

Bullish Trigger

✔ Close above $195.70

→ Confirms breakout

→ Targets: $200 → $212 → $225

Bearish Trigger

✔ Close below $183

→ Confirms earnings disappointment

→ Targets: $180 → $176 → $160

Risk Management

- Watch the first 30–45 minutes of post-earnings trading

- NVDA historically overreacts then trends

6. Final Summary

NVDA enters earnings with:

Fundamentals:

- Exceptional revenue growth

- Strong data center demand

- Massive AI capex tailwinds

- Highly optimistic CEO tone

- $60B buyback support

Technicals:

- Long-term bullish

- Short-term neutral/coiling

- Breakout levels tightly defined

Earnings Influence:

This will be a binary, high-volatility event with broader AI-sector implications.

Upper Path:

Strong guide → $195 → $200 → $212

Lower Path:

Soft guide or China issues → $183 → $180 → $176

Recent Analyst Commentary

- Susquehanna raised their NVDA price target from $210 to $230, describing the company as having “one of the largest opportunities ahead” in the entire AI semiconductor ecosystem.

- Oppenheimer reiterated Outperform and lifted their target from $225 to $265, noting that demand for Nvidia’s AI accelerators remains “extremely strong” with no signs of slowing.

- Wells Fargo (Aaron Rakers) reaffirmed Overweight and increased their target from $220 to $265, highlighting Nvidia’s dominant positioning across the AI compute stack and continued leadership in data-center silicon.

- Broad Street consensus remains firmly “Strong Buy”, with many analysts citing continued momentum in data-center revenue and the company’s early leadership in agentic AI models.

- Some market commentators warn that despite strong fundamentals, NVDA may face limited near-term upside due to heavy options positioning and gamma resistance around the $200 level, which could create a “sell-the-news” reaction even if results beat expectations.

Disclaimer: This is an AI-assisted analysis for informational purposes only. It is not financial advice or a recommendation to buy or sell securities.