Cowen Maintains Buy Rating and $195 Price Target for Alphabet Ahead of Q2 Earnings

Key Takeaways

- Cowen Upgrade: Maintained Buy rating, $195 price target.

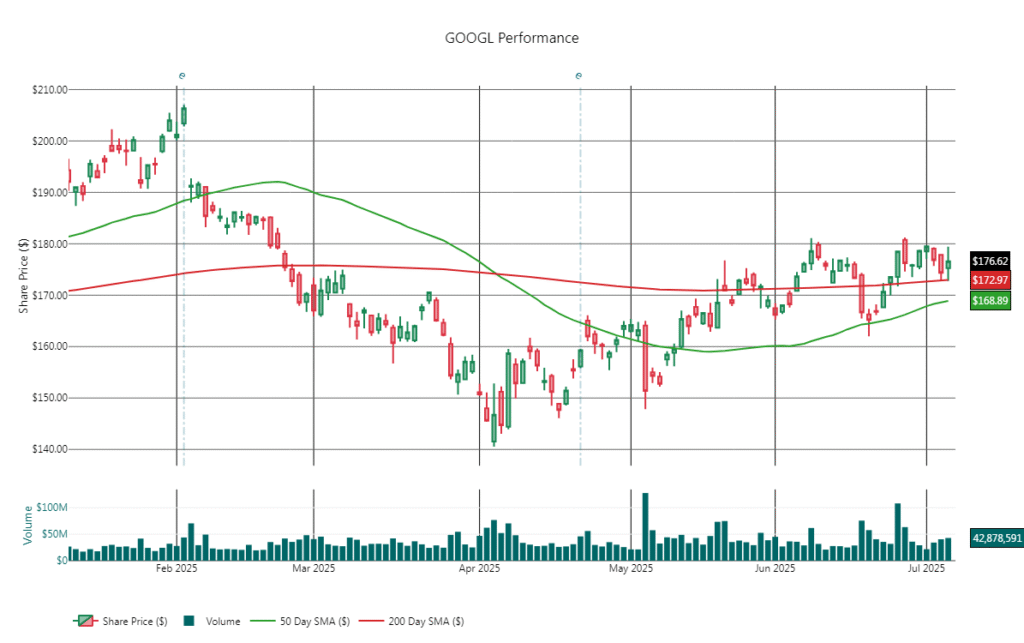

- Price Action: Closed at $176.62 (+1.30% on Jul 9); up ~9% since April earnings.

- Technical Pivot: $173.79 (50% Fibonacci) is critical support.

Cowen & Co. Outlook

- AI Push: Cowen sees generative-AI “Search AI Mode” driving deeper engagement.

- Risks: EU antitrust probe (Digital Markets Act fines up to 10% of revenue) and U.S. ad-tech trial in August.

- Partnerships: Samsung’s Galaxy Watch Ultra debuts with Google’s Gemini AI, underscoring hardware integration.

Recent Market Moves

- Close: $176.62 (+$2.26, +1.30%) on Jul 9.

- Since Q1: Shares up ~9% from April’s earnings, despite a 52-week peak of $207.05 on Feb 4.

- Earnings Confirmed: Alphabet will report Q2 results after the bell on Wednesday, July 23.

Technical Analysis Highlights

- Moving Averages

- Price sits above the 50-day ($168.60) and 200-day ($172.90) SMAs.

- Golden Cross formed in early June.

- Fibonacci Retracements

- 61.8%: $181.62 (first resistance)

- 50.0%: $173.79 (key support/pivot)

- 38.2%: $165.95 (secondary support)

- RSI & Volume

- RSI at ~56 (neutral territory).

- Rising volume on advances; lighter volume on pullbacks.

- Chart Patterns

- Ascending trendline of higher lows since April.

- Bullish flag consolidation broke out in early July.

What to Watch Next

- Bullish Path: Hold above $173.79 → target $181.62, then $192.83.

- Bearish Signal: Close below $173.79 on heavy volume → risk retest of $165.95.

- Catalyst: Q2 earnings report on July 23 will set the near-term tone.

Alphabet’s mix of entrenched ad revenues, AI innovations and device partnerships underpins Cowen’s Buy call—positioning GOOGL for further upside.

Disclaimer: This report was generated with AI assistance and does not constitute investment advice.