Bitcoin Holds Near $118K as Market Awaits Breakout

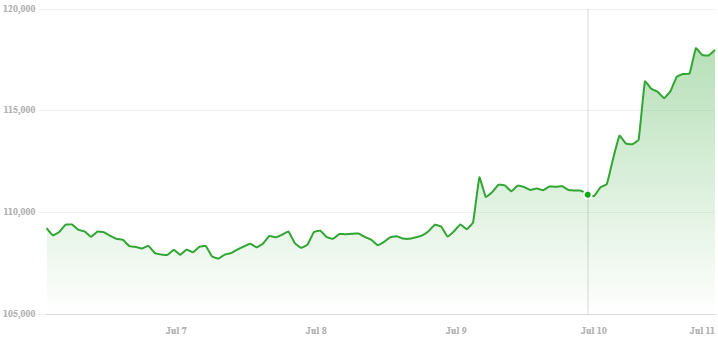

Bitcoin is trading around $118,007, just off intraday highs near $118,250. The cryptocurrency continues to hold strong above key support levels, with recent inflows and macro optimism fueling the latest climb.

Over the past five days, Bitcoin has surged from about $109,200 to $118,000 — a gain of nearly $8,800, or 8.1%. That move has come with relatively low volatility, making the rally even more notable.

What’s Driving the Move

- ETF inflows remain strong, with billions pouring into spot Bitcoin funds over recent days.

- Macroeconomic sentiment has turned supportive, as calls for U.S. interest rate cuts grow louder.

- Corporate demand is rising, with companies adding Bitcoin to their balance sheets.

- Volatility is unusually low, despite the asset sitting near all-time highs — a sign of tightening supply and market consolidation.

Levels to Watch

- Support: $107,000 to $113,000

- Resistance: $120,000 to $128,500

- Breakout potential: A move above $128K could open a path toward $140,000 based on current momentum and institutional flows.

Why It Matters

Bitcoin is sitting just below a major resistance zone. The current pattern — low volatility near all-time highs — has historically led to sharp price moves.

Right now, the setup leans bullish:

- ETF inflows are strong

- Supply is tight

- Long-term holders aren’t selling

- Macro conditions are favorable

And now, a solid 8% rally in just five days adds to the momentum.

But the move isn’t guaranteed.

If Bitcoin can’t break and hold above $120K soon, a short-term pullback toward $113K or lower is possible before any new highs.

A bigger move is coming — and while the odds favor an upward breakout, the next few sessions will likely determine the direction.