Netflix (NFLX) Q2 2025 Earnings Preview

Earnings Date: Thursday, July 17, 2025 (After Market Close)

Current Price (as of July 12): $1,245.11

52-Week Range: $587.04 – $1,341.15

YTD Performance: +39.69%

Since Last Earnings (April 2025): +26.03%

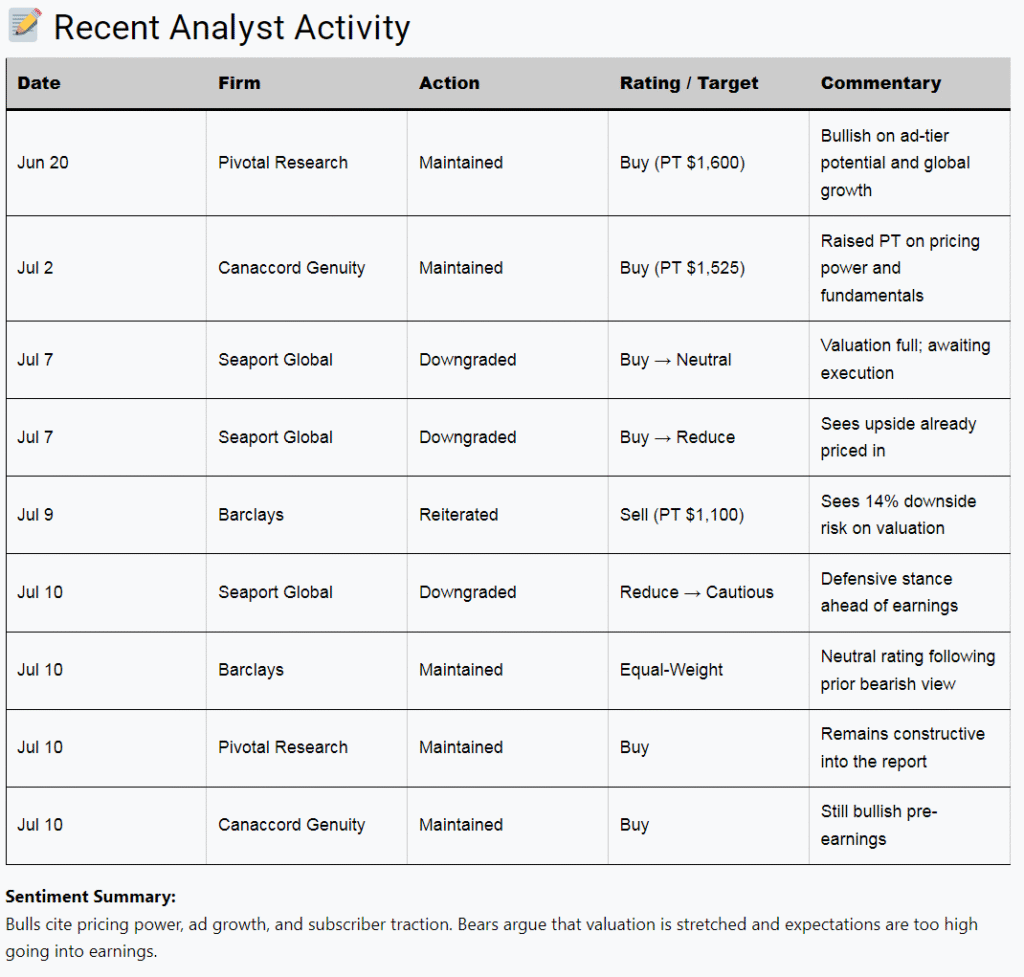

Netflix heads into Q2 earnings with strong momentum, driven by optimism around its ad-supported tier, subscription price increases, and broader operational execution. The stock is up nearly 40% year-to-date and has surged over 26% since its last earnings release, setting a high bar for the July 17 report.

📊 Earnings Preview

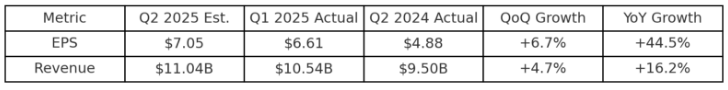

Netflix is expected to post another quarter of meaningful growth, with analysts forecasting steady quarter-over-quarter improvement and strong year-over-year gains. Attention remains on monetization of its in-house ad platform, subscriber behavior post-password crackdown, and international expansion.

Analysts expect nearly 7% sequential EPS growth and more than 44% year-over-year, with revenue rising over 16% YoY.

⚙️ Technical Setup (as of July 12)

| Indicator | Value / Signal |

|---|---|

| Price | $1,245.11 – above key moving averages |

| 50-day SMA | $1,216.22 – support zone |

| 200-day SMA | $971.70 – long-term trend intact |

| RSI (14) | 48.4 – Neutral momentum |

| Volume | Elevated, heavier on down days |

🔻 Key Support Levels

- $1,231 – $1,220: Near-term support zone

- $1,200: Psychological support

- $1,150: Deeper retracement area

🔺 Key Resistance Levels

- $1,290: Short-term ceiling

- $1,341: 52-week high

- $1,400: Psychological breakout level

Trend Summary:

The stock remains in a strong uptrend, with short-term consolidation just below resistance. Momentum is neutral, but price action suggests traders are waiting on the earnings catalyst to decide direction.

📈 Options Market Expectations

The options market is pricing in a ±9–10% move around earnings, equivalent to a $110–$125 swing in either direction.

| Implied Move | ±9–10% |

|---|---|

| Expected Range | ~$1,140 to ~$1,350 |

| Implied Volatility | ~43% – elevated vs. historical avg |

| Recent Earnings Moves | 1.53% (Q1), 9.7% (Q4), 11.1% (Q3) |

A major beat could push NFLX above its 52-week high. A miss could test $1,200 or lower.

✅ Actionable Take

If bullish:

- Look for breakout confirmation above $1,290 with strong volume.

- Pullback entries possible at $1,231–$1,216 support.

- Target upside: $1,340, then $1,400.

If bearish or cautious:

- Watch for a clean break below $1,231 as a near-term warning.

- A move below $1,200 could open downside toward $1,150.

Options Consideration:

- Elevated IV favors premium-selling strategies.

- Directional traders may prefer vertical spreads near the $1,240–$1,290 range.

- Straddle/strangle traders are positioned for a high-volatility event.

📌 Final Word

Netflix heads into Q2 earnings with strong fundamentals and a technically solid chart — but expectations are high, and analysts are split. With options pricing in a double-digit move and technical levels tightening, Thursday’s report could trigger a meaningful breakout or breakdown. Be ready.

This report was prepared with AI assistance and is for informational purposes only — it is not trading or investment advice.