ASML Q2 Earnings Preview: Analysts Cautious Despite Growth

ASML Holding NV will report its fiscal second-quarter earnings on Wednesday, July 16, 2025, before the U.S. market opens. While analysts are projecting robust year-over-year growth in both revenue and earnings, investor sentiment remains cautious, shaped by a history of volatile post-earnings reactions and recent mixed analyst calls.

💰 Q2 FY2025 Earnings Snapshot

- Quarter Ended: June 30, 2025

- EPS Estimate: $5.87

- Q2 FY24: $4.36 → +34.6% YoY

- Q1 FY25: $6.31 → -7.0% QoQ

- Revenue Estimate: $8.84B

- Q2 FY24: $6.71B → +31.7% YoY

- Q1 FY25: $8.49B → +4.1% QoQ

📌 Takeaway: The results are expected to reflect ongoing recovery in semiconductor capex, particularly in advanced-node EUV demand. However, a sequential dip in EPS may signal near-term softness.

🧾 Analyst Rating Recap

- June 26, 2025 – Jefferies:

Downgraded ASML from Buy to Hold, citing anticipated 16% decline in DRAM-related wafer fab equipment demand and persistent headwinds from China export restrictions. - June 3, 2025 – Barclays:

Downgraded from Overweight to Equal Weight, flagging slower EUV order growth and lowered expectations for High-NA system shipments amid macro pressures. - July 8, 2025 – Wells Fargo:

Maintained Overweight rating and raised price target to $890, expressing optimism on long-term EUV demand and structural growth from AI-driven semiconductor innovation. - July 15, 2025 – Seeking Alpha Contributor (Informal):

Issued a bullish commentary, upgrading their view to Buy based on a rebound in AI chip demand and broader capex recovery. Not an institutional rating, but reflects retail enthusiasm.

🎯 Sentiment Overview: Institutional analysts are leaning cautious near-term, while some maintain long-term optimism. Strong bookings and forward guidance will be key to shifting consensus.

📊 Technical Overview (as of July 15, 2025)

- Price: $806.73

- 50-Day SMA: $759.50 → Short-term trend support

- 200-Day SMA: $727.18 → Long-term trend support

- RSI (14): 61.1 → Neutral to slightly overbought

- Volume: 1.45M (above avg) → Healthy accumulation

📐 Fibonacci Levels (52W Low $578.51 → High $1,077.05):

- Support: $779 (key), $759–$727 (MA zone), $697 (deep retrace)

- Resistance: $828 (near-term), $878 (medium-term), $960 (long-term)

📈 Trend Bias:

- Price above both key SMAs

- Strong volume on rallies

- RSI suggests healthy but rising momentum

⚠️ Levels to Watch:

- Above $828: Opens door to $878 and $960

- Below $779: Risk of slide to $727 or $697

- RSI > 70: May trigger short-term overbought signals

🧠 Final Take

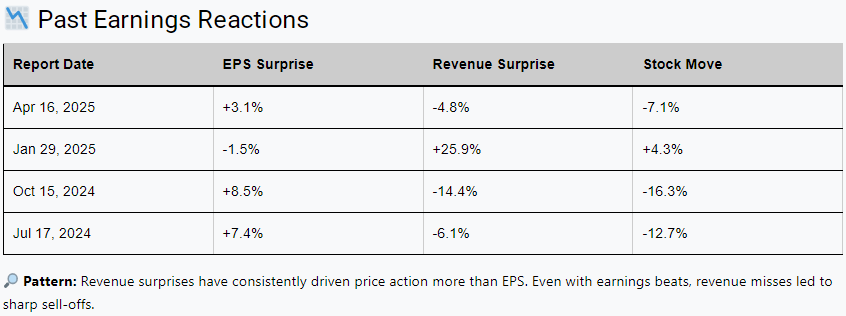

ASML is positioned to post strong YoY growth, but past reactions show that revenue misses — not earnings — have been the key trigger for downside moves. Guidance and bookings for H2 will be closely scrutinized, especially regarding EUV demand, China exposure, and AI-linked momentum.

Outlook:

If ASML beats on both top and bottom lines and signals strong visibility ahead, the stock could extend gains. But a revenue miss or cautious tone could pressure shares, even on an EPS beat — consistent with recent patterns.