Alphabet (GOOGL) Set to Report Strong Double-Digit Growth

Earnings Date: July 23, 2025

Fiscal Period Ended: July 1, 2025

📊 Key Estimates

Reporting Date: July 23, 2025 (Fiscal Q2 ended July 1)

- EPS Estimate: $2.17–$2.21 (vs. $2.03 last quarter)

→ YoY EPS Growth: +$0.28 to $0.32 (+14% to +16%) - Revenue Estimate: $93.7B–$94.0B (vs. $89.2B in Q1)

→ YoY Revenue Growth: +$9.0B to $9.3B (+10.6% to +11%)

🧠 Analyst Commentary

Consensus Rating:

- 15 Buy

- 4 Hold

- 0 Sell

Price Target Range: $200–$210

- Implies 6% to 9% upside from recent levels

EPS Revisions:

- Bank of America raised EPS forecast to $2.21 (above consensus)

- Jefferies projects ongoing strength in Cloud, especially AI-related enterprise demand

Key Drivers:

- Stable ad performance in Search and YouTube

- Google Cloud growth expected around +26% YoY

- AI investments creating long-term tailwinds

- Favorable macro and FX environment

🔻 Upgrade & Downgrade Summary

- Upgrades: BofA and Jefferies boosted targets on strong revenue pipeline

- Downgrades: One valuation-driven downgrade (neutral outlook due to regulatory overhang)

- CFRA: Still calls Alphabet a relative value in Big Tech

📺 YouTube Momentum

YouTube continues to be a standout asset for Alphabet.

Last Quarter Highlights:

- Ad Revenue: ~$8.9B (▲10.3% YoY)

- Surpassed Netflix in U.S. streaming share: 12.8% vs 8.3%

- Short-form content and connected TV growth fueling advertiser spend

- Subscription efforts gaining traction (YouTube Premium, Music, TV)

What to Watch:

- Any new monetization metrics (ARPU, engagement)

- Update on creator payouts and Shorts monetization

- International ad growth (APAC and LATAM)

☁️ Google Cloud Snapshot

Cloud Growth Estimate: ~26–28% YoY

Margin Commentary: Positive contribution expected for third straight quarter

Themes:

- Expanding AI/ML services for enterprise

- Competition with Microsoft Azure & AWS

- Watch for commentary on GPU availability, CapEx scale

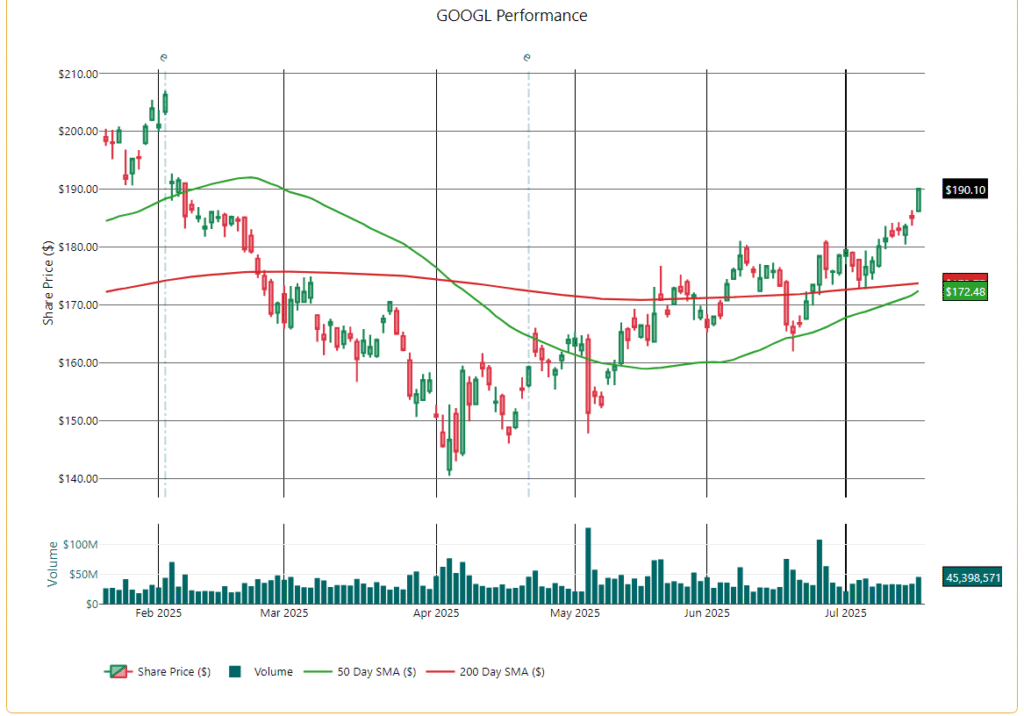

🔢 Fibonacci Retracement (from $207.05 high to $140.53 low)

- 0%: $140.53

- 23.6%: ~$156.40

- 38.2%: ~$169.05

- 50.0%: ~$173.79

- 61.8%: ~$178.53

- 100%: $207.05

Key Zones:

- Support: $178.53 → $173.79 → $169.05

- Resistance: $200–205 zone → $207.05

📈 Technical Indicators

- 50-Day SMA: $172.48

- 200-Day SMA: $173.77

✅ Price is well above both – strong trend confirmation - RSI (14): 72.19

⚠️ Overbought – potential short-term exhaustion - Volume: 45.3M

✅ Above average – confirms bullish conviction

📊 Trend Overview

- GOOGL has broken out of consolidation above key Fib levels and long-term averages.

- Current uptrend is strong, but momentum indicators suggest the rally may be stretched.

- A retest of support levels ($178–174 zone) would be healthy if momentum fades.

🔍 What to Expect

- Upside Target: $200–207 if $190.10 holds.

- Downside Watch: Pullback to $178.53 or $173.79 if RSI-driven selling appears.

✅ Actionable Takeaways

- Long Position: Trail stops to lock in gains near $190.

- Buy-the-Dip: Re-entry around $178–174 zone.

- Breakout Trade: Above $200, target $207+.

🏛️ Risk Watch: DOJ & Regulatory

- Ongoing antitrust scrutiny around Chrome, Search, and Android

- Potential divestiture scenarios in 2026 remain background noise

- Regulatory comments in earnings call could sway sentiment

📍 Key Areas to Monitor in the Call

- Ad Trends: Is the rebound sustainable in macro-sensitive sectors?

- YouTube: More than ads? Is it becoming Alphabet’s crown jewel?

- CapEx: Any changes to ~$75B annual CapEx trajectory?

- Cloud Margins: Stability or compression under price pressure?

- AI Strategy: Updates on Gemini, model monetization, and distribution

🧾 Final Takeaway

Alphabet is positioned to report another strong quarter, with analysts expecting solid double-digit YoY growth in both earnings and revenue. YouTube and Google Cloud remain the core growth drivers, while Search provides a stable cash engine. Analysts are mostly bullish, though some caution around valuation and regulatory risk is emerging.

Outlook: Strong results expected, but forward guidance and clarity on ad trends, CapEx, and AI monetization will determine market reaction.

This report is generated with AI assistance and is not investment advice.