Tesla (TSLA) Faces Margin Pressure and Lower Revenue Expectations

Earnings Date: Wednesday, July 23, 2025 (after market close)

Earnings Call: 5:30 p.m. ET

🧾 Street Expectations

- Revenue: $22.4B – $22.8B (↓ ~11–12% YoY)

- EPS (Adj.): $0.40 – $0.44 (↓ ~20–25% YoY)

- Auto Gross Margin: Estimated at 14–16% (vs. 18.3% YoY)

📦 Already Reported: Q2 Key Metrics

- Vehicles Produced: 410,244 units

- Vehicles Delivered: 384,122 units (↓13.5% YoY)

- Energy Storage Deployments: 9.6 GWh

🔍 Key Themes to Watch

1. Margin Pressures Continue

– Aggressive price cuts, weaker demand, and loss of EV tax credits are squeezing profitability.

– Emission credit sales may also decline, adding pressure to gross margin.

2. Robotaxi Push

– Tesla began a pilot in Austin in June. Updates on rollout plans, NHTSA safety feedback, and timeline will be closely watched.

3. New Model Watch

– The market awaits any update on the low-cost “Model Q” (expected late 2025).

– Progress on Tesla’s humanoid robot project may also come up.

4. Guidance Reset?

– Tesla pulled full-year guidance last quarter. Analysts now expect 1.35–1.66M deliveries (vs. 1.81M in 2024).

– Clarity on demand recovery or revised targets will be key.

📊 Options Market Setup

– Implied move: ±7% post-earnings (about $22 up/down from ~$332 price level).

– Tesla has historically been volatile post-earnings, especially when guidance is vague or innovation updates underwhelm.

🧠 Analyst Sentiment

- Bullish: Wedbush ($500 PT), Deutsche Bank ($345 PT) — optimism tied to AI, robotaxi, and Model Q.

- Bearish: UBS, JPMorgan — citing valuation and margin risks (PTs range $115–$215).

- Mixed Overall: Debate continues over whether Tesla remains a growth story or needs to be valued as a mature automaker.

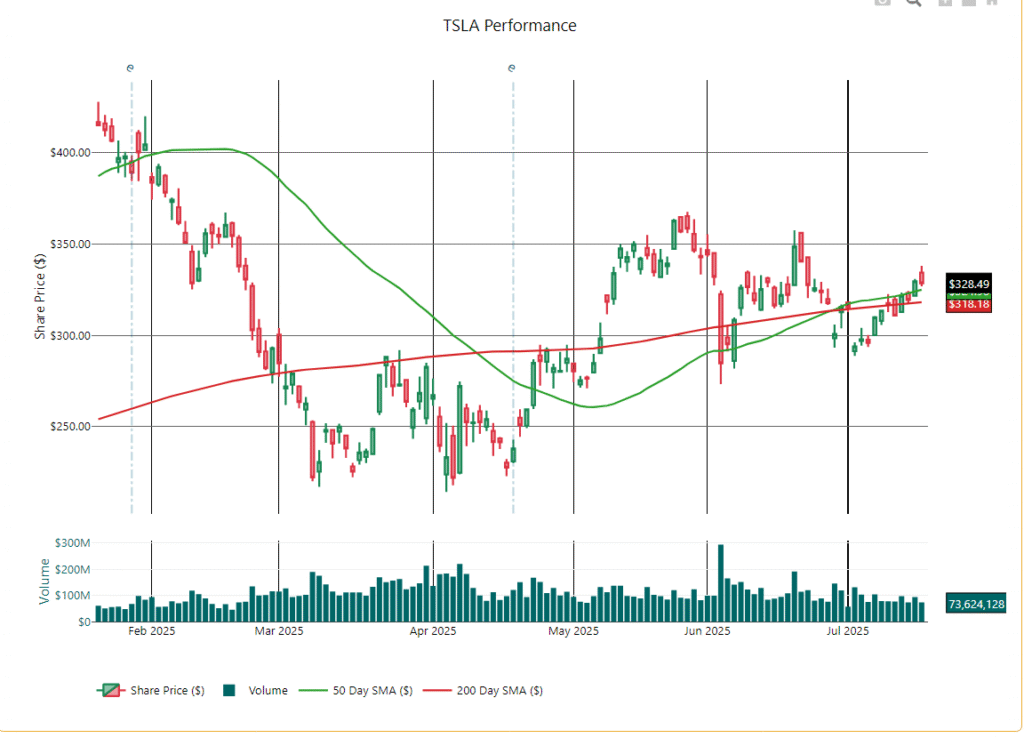

TSLA Technical Analysis (as of July 21, 2025)

Current Price: $328.49

52-Week Range: High $488.54 → Low $182.00

🔢 Fibonacci Retracement (High to Low):

- 38.2%: ~$323 → Current support zone

- 50.0%: ~$335 → Immediate resistance

- 61.8%: ~$347 → Next upside target

📈 Technical Snapshot (TSLA)

- RSI (14-day): 55.3

→ Neutral; not overbought or oversold - 20-day SMA: $317.67

→ Near-term support - 50-day SMA: $324.98

→ Price slightly above; bullish tilt - 200-day SMA: $318.18

→ Below current price; improving long-term trend - Volume (Last): 73.6M

→ Below avg (~98M); weak conviction

🧩 Market Structure & Outlook

- Trend: TSLA has reclaimed key moving averages, indicating early recovery signs.

- Volume is subdued → caution on conviction.

- Support Levels:

- $323 (Fib 38.2%)

- $317 (20-day SMA)

- $310 (recent low support zone)

- Resistance Levels:

- $335 (Fib 50%)

- $347 (Fib 61.8%)

- $360 (psychological round number)

📌 Summary & Trading View

- Neutral to bullish short-term bias while holding above $323.

- Break above $335 would confirm bullish continuation toward $347–$360.

- Drop below $323 opens room to retest $317 and possibly $310.

- Volume trend does not yet confirm strong buying momentum — watch for surge on breakout.

📌 Final Thought

Tesla heads into Q2 earnings with momentum around its AI and robotaxi vision—but underlying auto performance is weakening. To impress investors, Tesla needs more than futuristic promises: firm product timelines and margin stabilization are crucial this quarter.

This report is generated with AI assistance and is not investment advice.