CrowdStrike (CRWD) Revenue Tops Expectations but Margins Disappoint

CrowdStrike (CRWD) reported Q2 FY26 results with revenue up 21% year over year to $1.17B and net new ARR of $221M, both ahead of expectations, but the stock fell about 4% in overnight trading as investors focused on a swing to a GAAP net loss, rising stock-based compensation, and margin pressure despite strong top-line growth.

Earnings Results

- Revenue: $1.17B, up 21% YoY (beat expectations).

- Subscription Revenue: $1.10B, up 20% YoY.

- ARR: $4.66B, up 20% YoY, with net new ARR of $221M (ahead of expectations).

- Non-GAAP EPS: $0.93 vs. $0.88 last year (record high).

- GAAP EPS: loss of ($0.31) vs. profit of $0.19 last year, due to higher stock comp, incident costs, and strategic plan charges.

- Cash Flow: FCF $284M (up modestly from $272M).

Guidance

- Q3 FY26 revenue: $1.21B–$1.22B

- Non-GAAP EPS: $0.93–$0.95

- Full-year FY26 revenue: $4.75B–$4.81B

- Full-year Non-GAAP EPS: $3.60–$3.72

This was slightly above prior guidance, but not a big raise.

Operational Highlights

- Gross margin dipped:

- GAAP subscription gross margin 77% vs. 78% last year.

- Non-GAAP subscription gross margin 80% vs. 81%.

- Large GAAP loss: driven by $284M stock-based comp, $35M July 19 incident costs, and $38M in “strategic plan” charges.

- Free cash flow margin fell to 24% vs. 28% a year ago.

- Announced acquisition of Onum Technology.

Why Stock Reacted Negatively

- GAAP Loss & Higher Costs

- Despite strong revenue and ARR, GAAP results swung to a $77.7M loss from a $47M profit last year.

- Investors focused on rising expenses: sales & marketing +26% YoY, R&D +38%, G&A +67%.

- Margins Compression

- Gross margin slipped, and free cash flow margin declined from 28% to 24%.

- Signals higher costs to sustain growth.

- Muted Guidance Raise

- Management beat expectations in Q2 but raised full-year guidance only slightly, suggesting limited near-term acceleration.

- Lingering “July 19 Incident” Costs

- Ongoing costs tied to last year’s sensor crash remain a drag, raising concerns about execution risk.

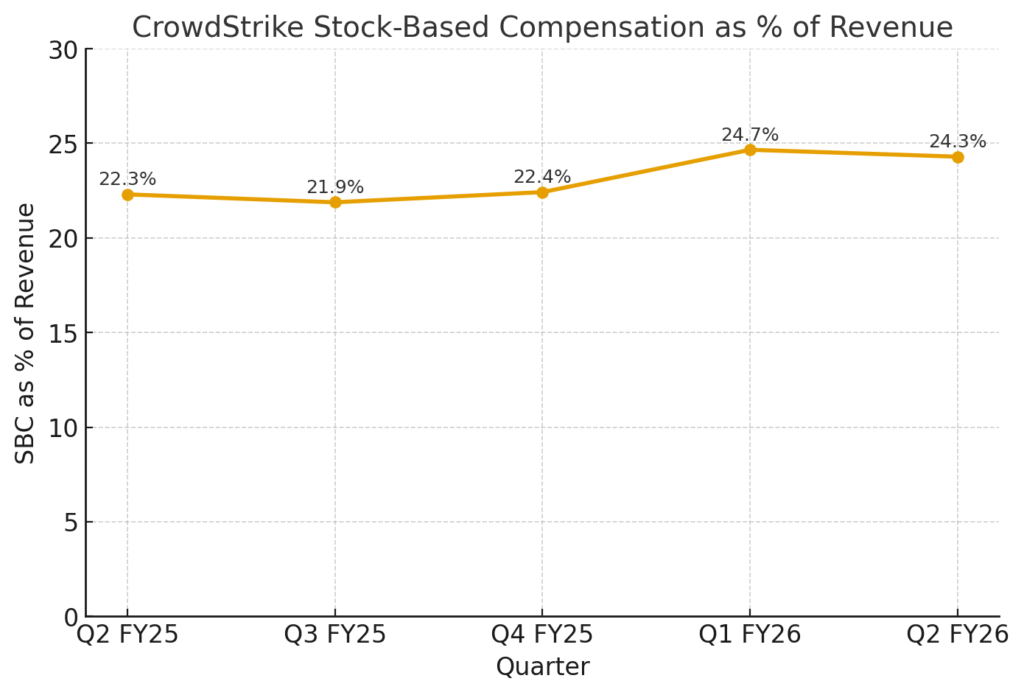

CrowdStrike’s stock-based compensation (SBC) as a % of revenue:

- It has climbed from around 22% in Q2 FY25 to nearly 24% in Q2 FY26.

- The ratio has stayed elevated quarter after quarter, even as revenue grows.

- This level is well above peers, which usually range closer to 10–15%.

The trend confirms that SBC is a structural profitability drag and a key reason GAAP losses are widening.

Key Technical Summary

| Indicator | Signal |

|---|---|

| Short-Term Moving Averages | Strong Sell |

| Long-Term (200-day MA) | Modestly supportive (Buy) |

| RSI | Neutral |

| MACD | Slightly mixed/bullish |

| Pattern (Bear Flag) | Negative outlook |

| Accumulation | Weak (E rating) |

| Relative Strength | Moderate (RS = 75) |

What This Means

- Short-term momentum looks shaky: the stock is below most key moving averages and showing a bear-leaning pattern.

- There’s a risk of further downside, especially if volume confirms continued selling.

- A stabilizing element is that CRWD remains above its 200-day average—suggesting some longer-term support is holding.

- Watch closely for a bounce off the $410–$421 support zone. A drop below that could signal deeper weakness.

- Conversely, overcoming resistance levels (like the 50-day MA) with strength and volume could help reverse the tone.

Context vs. Peers

- CrowdStrike is still growing faster than legacy peers (like $PANW, $FTNT), but margins are under pressure unlike Palo Alto, which recently emphasized operating leverage.

- Investors may be rotating to names showing both growth and expanding margins.

Takeaway:

CrowdStrike’s fundamentals remain solid, with strong ARR growth and customer adoption. But investors punished the stock because higher expenses, margin compression, and lingering one-off costs offset the headline beats. Guidance was good, not great—so the stock sold off on valuation and profitability concerns.