Netflix (NFLX) Technical Analysis: Bullish Signals indicate potential upside

1. Trend Overview

- Long-term trend = Uptrend

Price remains well above the 200-day SMA ($1,129) and is recovering after a pullback. - Medium-term trend = Weakening but stabilizing

50-day SMA ($1,178) is sloping downward but price has reclaimed the 200-SMA → bullish stabilization. - Short-term trend = Turning up

Last 2–7 days show higher lows and improving momentum.

📊 2. Key Indicators

RSI

- Current RSI ranges (short to long): 37–54

- Short-term RSI (5–7 days) is still soft/oversold-ish (37–39)

- Medium-term RSI (20–31 days) = 41–45 → Neutral

- Long-term RSI (365 days) = 54 → Still in bull trend

→ Momentum is shifting from oversold → recovery.

Williams %R

- Near-term Williams = –59% to –85%, deeper oversold on longer windows.

- 365-day Williams = –32%, healthy long-term uptrend.

→ Oversold signals lining up with a bounce already in progress.

ADX (trend strength)

- Short-term ADX = 34–52 → Strong trend, but this was during the recent down-leg.

- Medium/long-term ADX weakens significantly (8–13) → No major long-term trend change.

→ Selling pressure was strong but is fading. Buyers are now reasserting.

Volatility (STD)

- Recent STD = 50–60

- 180–200 day STD = 119–120

- 365 day STD = 221

→ Current volatility is much lower than long-term norms.

→ Split + earnings cycle + bounce = volatility expansion likely ahead.

🟥 3. What the Charts Show

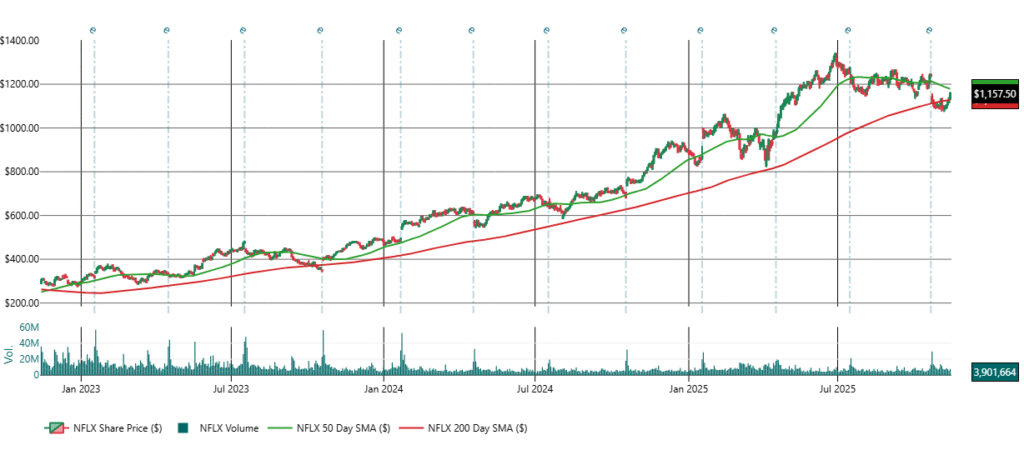

Long-Term Chart (2-year)

- NFLX has been in a clear structural uptrend since early 2023.

- Higher highs + higher lows are intact.

- Repeated 50-day SMA resets followed by trend continuation.

Big-picture: Trend remains bullish.

1-Year Chart

- Peaked around $1,300–$1,320

- Pulled back to the $1,100–$1,120 support

- Buyers stepped in exactly at the 200-day SMA.

This looks like a classic retest of major support → bounce.

6-Month Chart

- Price slipped under 50-day SMA but found strong support at the 200-SMA.

- Current price back above the 200-SMA → bullish early reversal.

3-Month Chart

- Detailed candles show:

- Breakdown in early Oct

- Capitulation wick on heavy volume

- Gradual stabilization

- Higher lows forming now

- 50-day SMA still declining, but flattening → reversal setup.

🔍 4. Pattern Detection

Based on the uploaded charts:

Pattern #1: Rounded Bottom / U-shaped recovery

- Forming between Oct 10 – Nov 10

- Higher lows confirm demand returning.

Pattern #2: 200-day SMA Bounce

- Strong bullish signal in trending names.

- Historically NFLX rallies 10–25% from 200-SMA touches.

Pattern #3: Mini Inverse Head & Shoulders

- Left shoulder: ~Oct 8

- Head: ~Oct 21 low

- Right shoulder: Nov 5–8

Neckline = ~$1,185

A break above this completes a bullish pattern.

🎯 5. Key Price Levels

Support

- $1,120 (strong) – 200-day SMA

- $1,080 – recent capitulation zone

- $1,000 psychological

Resistance

- $1,178–1,185 = 50-day SMA + neckline

- $1,240 minor

- $1,300–1,320 major, yearly high

📌 6. Stock Split Impact (Nov 17)

Expect:

- Short-term volatility spike

- Retail inflow

- Options volume increase

- Often triggers a pre-split run-up, especially when technicals align (bouncing off 200-SMA).

NFLX historically trades well into splits.

🧭 7. Actionable Opinion

Bullish case (higher probability)

NFLX bounced from a big support (200-day SMA) and is gaining strength. If it breaks above $1,185, it can run toward:

- $1,240

- $1,300 (pre-split high)

- $1,350 extension after the split liquidity wave

Bearish case

If it loses $1,120, sellers take control again.

Downside targets:

- $1,080

- $1,000

✔️ Summary

NFLX is bouncing off its 200-day SMA after a multi-week pullback, with RSI recovering, selling pressure easing, and a potential inverse head-and-shoulders forming. Above $1,185 triggers a bullish continuation toward $1,240 and possibly $1,300. The upcoming Nov 17 stock split may add momentum. A drop below $1,120 invalidates the recovery.

Disclaimer: This AI-assisted analysis is for educational purposes only and is not financial advice. Always do your own research or consult a licensed professional before making investment decisions.