S&P 500 ($SPX) Maintains Uptrend Despite Recent Decline

Market Context

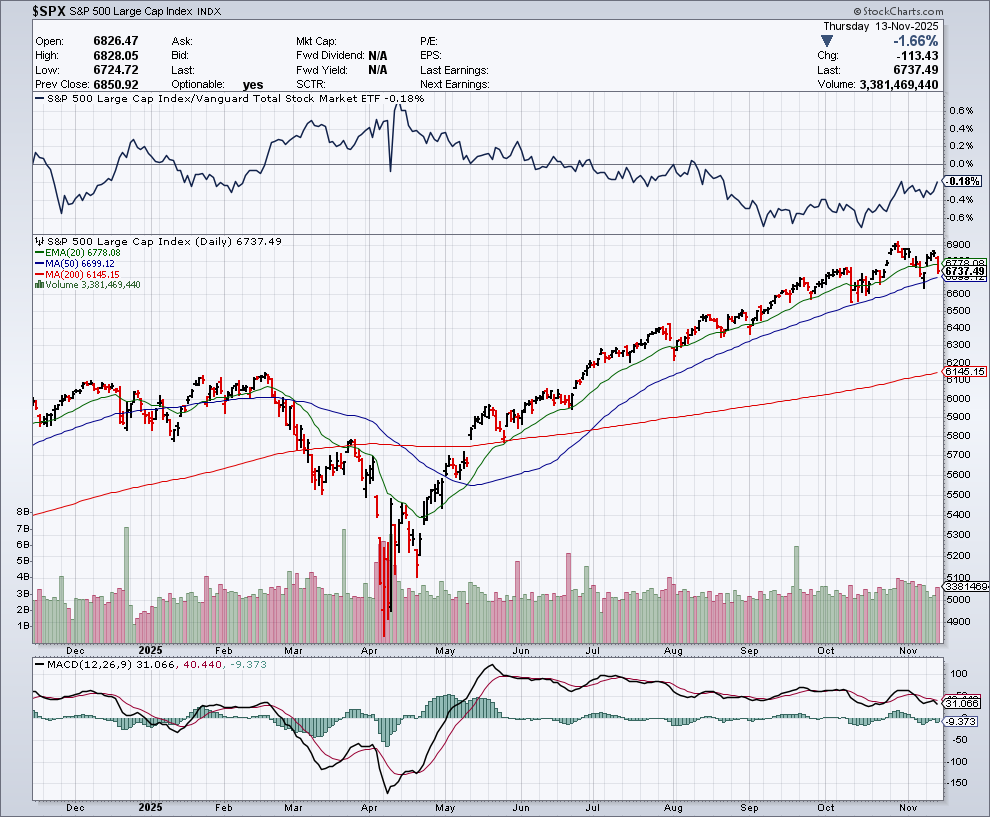

The S&P 500 declined 1.66% to 6,737.49, pulling back sharply into a major support cluster. Despite the drop, the broader uptrend remains intact as long as 6,700 holds.

📈 Trend & Pattern Structure

- SPX continues to trade inside a rising channel that began in April.

- Price has consistently respected both the ascending trendline and the 50-day moving average.

- Today’s decline stopped exactly at that support convergence, preserving the uptrend.

Primary Pattern:

➡ Ascending Channel / Trendline Support

Status:

➡ Uptrend intact unless support breaks

📉 Critical Downside Level

➡ 6,700 — Must-Hold Support

This level is critical because it combines:

- The ascending trendline

- The 50-day MA (~6,699)

- A multi-week support shelf

Breakdown Triggers

- Close < 6,700 → first warning

- Two closes < 6,650 → confirmed trend break

- Downside targets: 6,500 → 6,300 → 6,150 (200-day MA)

📈 Upside Levels

If 6,700 holds, the uptrend is expected to continue.

- First resistance: 6,800 – 6,830

- Breakout target: 6,950

- Channel extension: 7,150 – 7,200

📊 Indicators

- MACD: Momentum weakening; watching for a bear cross. Not confirmed yet.

- Volume: Elevated but not capitulatory — consistent with a normal pullback in trend.

- Relative Strength: Still making higher lows, matching a trending market.

📝 Summary

- The entire bullish structure hinges on 6,700.

- A bounce here would maintain the rising channel with upside toward 6,950–7,200.

- A break below 6,700, especially confirmed under 6,650, would signal a trend reversal with room to retrace toward 6,500 and potentially 6,300.