Newmont (NEM) Technical Analysis Shows Bullish Outlook

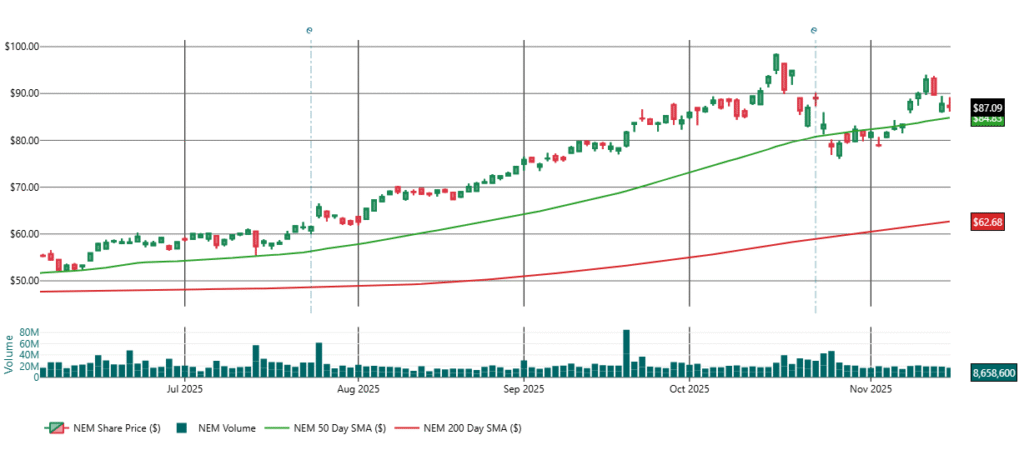

Price: $87.09

Trend: Bullish but in short-term consolidation

Gold: $4,034 (-0.99%)

1. Current Trend Overview

- Above 50-day SMA ($84.50–$84.60) → trend support being tested

- Well above 200-day SMA ($62.68) → long-term uptrend intact

- Momentum neutral (RSI 52.56, W%R -44)

- ADX 22 → trend softening but not broken

- Volume low → normal consolidation, not distribution

2. Fibonacci Retracement

(Matches your 1-yr chart: bottom near $52 in Jan, peak near $98 in late Oct)

Fibonacci Levels

| Level | Price | Why It Matters |

|---|---|---|

| 0% | $98.58 | 52-week high / primary resistance |

| 23.6% | $88.65 | Current rejection zone (fits chart perfectly) |

| 38.2% | $82.97 | FIRST major support if 50-day breaks |

| 50.0% | $75.29 | Midpoint + August base |

| 61.8% | $67.60 | Deep pullback level |

| 100% | $52.00 | January low |

Current Position vs. Fib

NEM at $87.09 is just below the 23.6% retracement ($88.65).

This aligns with your chart showing repeated failures at $88–$90.

If price reclaims the 23.6% level → upside momentum restarts.

If price loses $84.50 → the 38.2% retracement ($82.97) is next.

This Fibonacci structure is fully aligned with the printed charts.

3. Updated Support & Resistance

Resistance Levels

- $88.65 (Fib 23.6%)

- $92.50–$93.00 (swing highs)

- $98.50–$100.00 (Fib 0% / 52-week high)

Support Levels

- $84.50–$85.00 (50-day SMA)

- $82.97 (Fib 38.2% — key support)

- $78.00–$80.00 (prior base)

- $62.68 (200-day SMA)

Critical takeaway:

$84.50 = MUST HOLD to keep trend intact

$82.97 = FIRST major Fibonacci support

4. Gold Correlation & Macro Overlay

- Gold currently $4,034, pulling back from $4,200 resistance

- Short-term consolidation, long-term trend bullish

- As per uploaded gold report:

- Support: $3,925

- Resistance: $4,200

- Medium-term target: $4,400–$4,500

- If gold drops → NEM follows

- If gold reclaims $4,200 → NEM likely retests $92–$98 quickly

5. 7–30 Day Projection Model

Assumptions

- Gold holds above $3,925

- Equity markets remain stable

- Gold volatility remains elevated but trending bullish medium-term

🟩 7-Day Outlook (Very Near-Term)

Base case (60% probability):

NEM trades between $84.50 and $89.00, respecting the 50-day SMA.

- Momentum indicators neutral

- Chart shows tightening consolidation

- Volume contracting → suggests a coil

Upside scenario (25%):

Break above $88.65 (Fib 23.6%) → move toward $92.00–$93.00.

Downside scenario (15%):

Break below $84.50 → immediate drop to $82.97 (Fib 38.2%).

🟦 30-Day Outlook (Intermediate-Term)

Bullish case (55% probability)

Conditions:

- Gold reclaims $4,150–$4,200

- NEM holds $84.50

- ADX rises above 25 confirming trend strength

Targets (over 30 days):

- $92.50

- $98.50 (52-week high)

- Potential breakout >$100 if gold spikes to $4,250+

This aligns with medium-term gold projections in your file.

Neutral / Consolidation case (30% probability)

If gold stays rangebound $3,950–$4,100:

NEM trades sideways between $82.97–$89.00.

Patterns likely:

- Bullish flag

- Ascending channel

- Cup-and-handle attempt

Bearish case (15% probability)

Triggered by gold breaking below $3,925:

Downside targets:

- $82.97 (Fib 38.2%)

- $78–$80

- Extreme stress: retest of $75 (Fib 50%)

This scenario requires a broader gold correction.

6. Final Assessment

- NEM remains structurally bullish

- Currently sitting on trend-critical 50-day support

- Fibonacci confirms $88.65 is the next upside trigger

- Gold’s short-term weakness explains NEM’s current pullback

- 7–30 day bias = bullish with consolidation, unless gold breaks $3,925

Disclaimer: This report is generated with AI assistance and is for informational purposes only. It is not financial advice or a recommendation to buy or sell any security.