| 6,635.11 | Price Crosses 18-40 Day Moving Average |

| 14 Day RSI at 80% | 5,584.15 | |

| 14 Day RSI at 70% | 5,329.80 | |

| 5,310.23 | 3-10 Day MACD Oscillator Stalls |

| Pivot Point 3rd Level Resistance | 5,268.31 | |

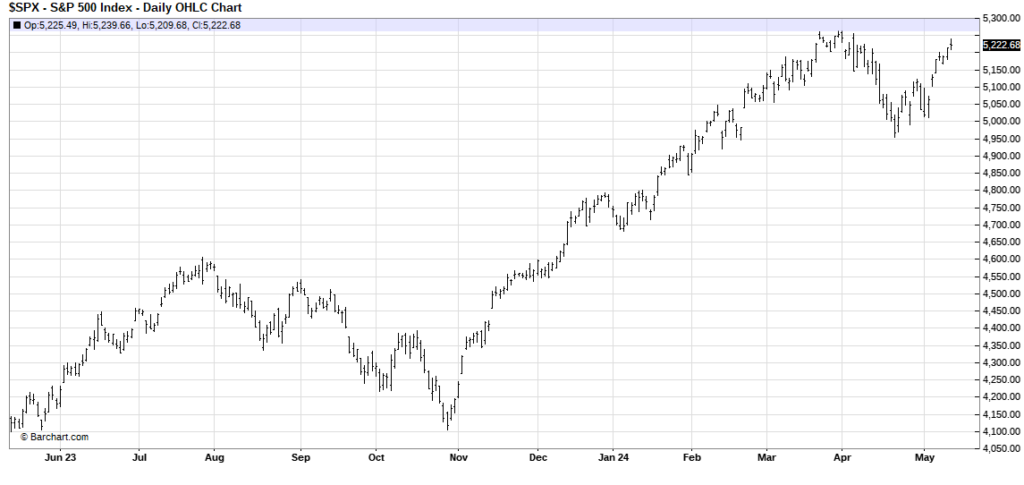

| 52-Week High | 5,264.85 | |

| 13-Week High | 5,264.85 | |

| Pivot Point 2nd Level Resistance | 5,253.99 | |

| Price 3 Standard Deviations Resistance | 5,252.62 | |

| Price 2 Standard Deviations Resistance | 5,247.12 | |

| Price 1 Standard Deviation Resistance | 5,239.96 | |

| 1-Month High | 5,239.66 | |

| High | 5,239.66 | High |

| Pivot Point 1st Resistance Point | 5,238.33 | |

| 5,232.56 | 14 Day %k Stochastic Stalls |

| 5,224.01 | Pivot Point |

| Last | 5,222.68 | Last |

| Previous Close | 5,214.08 | Previous Close |

| Low | 5,209.68 | Low |

| Pivot Point 1st Support Point | 5,208.35 | |

| Price 1 Standard Deviation Support | 5,205.40 | |

| Price 2 Standard Deviations Support | 5,198.24 | |

| Pivot Point 2nd Support Point | 5,194.03 | |

| Price 3 Standard Deviations Support | 5,192.74 | |

| 5,189.84 | 14-3 Day Raw Stochastic at 80% |

| Pivot Point 3rd Support Point | 5,178.37 | |

| 5,164.94 | 14-3 Day Raw Stochastic at 70% |

| 5,150.41 | Price Crosses 9 Day Moving Average |

| 5,144.38 | Price Crosses 40 Day Moving Average |

| 5,133.24 | 38.2% Retracement From 13 Week High |

| 5,130.37 | 38.2% Retracement From 4 Week High |

| 5,126.33 | 14 Day RSI at 50% |

| 5,117.09 | Price Crosses 40 Day Moving Average Stalls |

| 5,115.12 | 14-3 Day Raw Stochastic at 50% |

| 5,096.61 | 50% Retracement From 4 Week High/Low |

| 5,096.15 | Price Crosses 18 Day Moving Average |

| 5,092.58 | 50% Retracement From 13 Week High/Low |

| 5,082.21 | Price Crosses 9-40 Day Moving Average |

| 5,065.30 | 14-3 Day Raw Stochastic at 30% |

| 5,062.85 | 38.2% Retracement From 4 Week Low |

| 5,062.44 | 3-10-16 Day MACD Moving Average Stalls |

| 5,051.92 | 38.2% Retracement From 13 Week Low |

| 5,040.40 | 14-3 Day Raw Stochastic at 20% |

| 5,035.69 | Price Crosses 9 Day Moving Average Stalls |

| 5,022.21 | Price Crosses 18 Day Moving Average Stalls |

| 1-Month Low | 4,953.56 | |

| 13-Week Low | 4,920.31 | |

| 4,819.54 | 61.8% Retracement from the 52 Week Low |

| 14 Day RSI at 30% | 4,794.38 | |

| 4,681.99 | 50% Retracement From 52 Week High/Low |

| 4,544.43 | 38.2% Retracement From 52 Week Low |

| 14 Day RSI at 20% | 4,379.45 | |

| 4,228.12 | Price Crosses 9-18 Day Moving Average |

| 52-Week Low | 4,099.12 | |

| N/A | 14 Day %d Stochastic Stalls |